Fiserv: Execution Reset in a Durable Payments Franchise

Why a 2025 Operating Leverage Breakdown Has Created a Mispriced Infrastructure Compounder And What Needs to Normalize for Re-Rating

Forwords from Talon: The Adyen Parallel

Before turning to the core analysis, it is important to frame Fiserv’s current situation through a relevant market precedent. The most instructive comparison is Adyen’s 2023-2024 reset, which provides a clear template for how infrastructure-style payment businesses are repriced when operating leverage breaks and how quickly that repricing can reverse once execution credibility is restored.

Adyen’s drawdown was not caused by demand destruction or competitive displacement. It was triggered when incremental margins collapsed after years in which scale masked rising costs. Revenue growth slowed modestly, expenses proved stickier than expected, and operating leverage flipped from a structural tailwind into a headwind. The market interpreted this as a permanent impairment rather than an execution lapse, compressing the valuation aggressively and pricing in a structurally lower margin regime. Yet the core business remained intact: transaction volumes continued, client relationships were stable, and Adyen’s platform remained mission-critical.

The subsequent 100%+ share price rally was not driven by a return to hypergrowth or narrative-driven optimism. It was driven by execution normalization. Management reset expectations, imposed cost discipline, restored incremental margins, and demonstrated that even lower growth could still produce compounding cash flows once operating leverage returned. As soon as the market recognized that the margin collapse was execution-driven rather than structural, valuation re-rated rapidly. The inflection came from proof, not promises.

Fiserv now sits in a strikingly similar position. In 2025, scale stopped masking execution issues, incremental margins collapsed, and the market extrapolated weakness as permanent. Yet demand did not collapse, the platform did not lose relevance, and cash flow remained positive. As with Adyen, the valuation reset reflects a loss of confidence in operating leverage, not a broken business model.

This parallel matters because it reframes the investment debate. Fiserv does not need to reclaim prior growth rates or peak multiples to generate meaningful upside. It needs to do what Adyen did: restore cost discipline, improve revenue mix, and demonstrate that incremental revenue once again converts into operating income and free cash flow. If that proof emerges, valuation can re-rate sharply and quickly. History shows that when the market realizes it has priced the wrong steady state, recovery is not gradual, it is violent.

Executive Summary

The market is currently mispricing Fiserv as if the 2025 guidance reset represents a permanent impairment to its earnings power rather than a cyclical and execution-driven trough. In reaction to slowing organic growth, margin pressure, and reduced forward visibility, investor expectations have swung decisively toward a stagnation narrative. This overlooks the reality that Fiserv remains a deeply embedded financial infrastructure provider with high switching costs, recurring revenue, and substantial free cash flow generation. The business has not lost relevance or structural demand; it has lost growth credibility temporarily due to execution slippage.

Current pricing implicitly assumes a low-growth, low-leverage outcome where operating margins fail to recover and incremental revenue does not translate into earnings or cash flow. That assumption is overly pessimistic. Fiserv does not need to return to peak growth or margin levels to justify materially higher valuation. Asymmetry emerges because downside is bounded by ongoing profitability and cash flow durability, while upside is unlocked through achievable execution normalization. Even modest reacceleration in organic growth and stabilization of operating leverage would meaningfully re-rate the equity, creating a skewed risk–reward profile in favor of long-term investors.

The primary catalysts are observable execution outcomes, not strategic rhetoric. First, sequential improvement in organic revenue growth, particularly within Merchant Solutions, will be the earliest signal that demand and pricing dynamics are stabilizing. Second, evidence of incremental margin improvement and better free cash flow conversion will confirm that operating leverage is returning and that cost discipline is aligning with revenue realities. Third, a visible shift in capital allocation toward free-cash-flow-funded buybacks and leverage stabilization will reinforce balance sheet credibility. Finally, consistent delivery under the new leadership structure, reflected in improved guidance

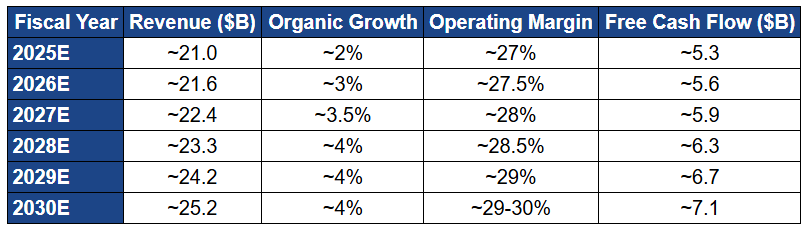

This profile assumes stabilization rather than heroics. Revenue growth recovers gradually, margins expand modestly as operating leverage normalizes, and free cash flow remains durable and scalable over time.

Fiserv is undervalued and asymmetrical, despite lowered guidance and a structurally lower near-term growth profile. The market is pricing in a stagnation scenario that underestimates the company’s cash flow durability and overstates the permanence of recent execution issues. Downside is limited by profitability and embedded infrastructure economics, while upside is driven by realistic execution recovery rather than aggressive assumptions. Alpha Talon’s view is constructive but disciplined: confirmation will matter, but at current levels the risk–reward profile is skewed meaningfully to the upside.

Company Overview

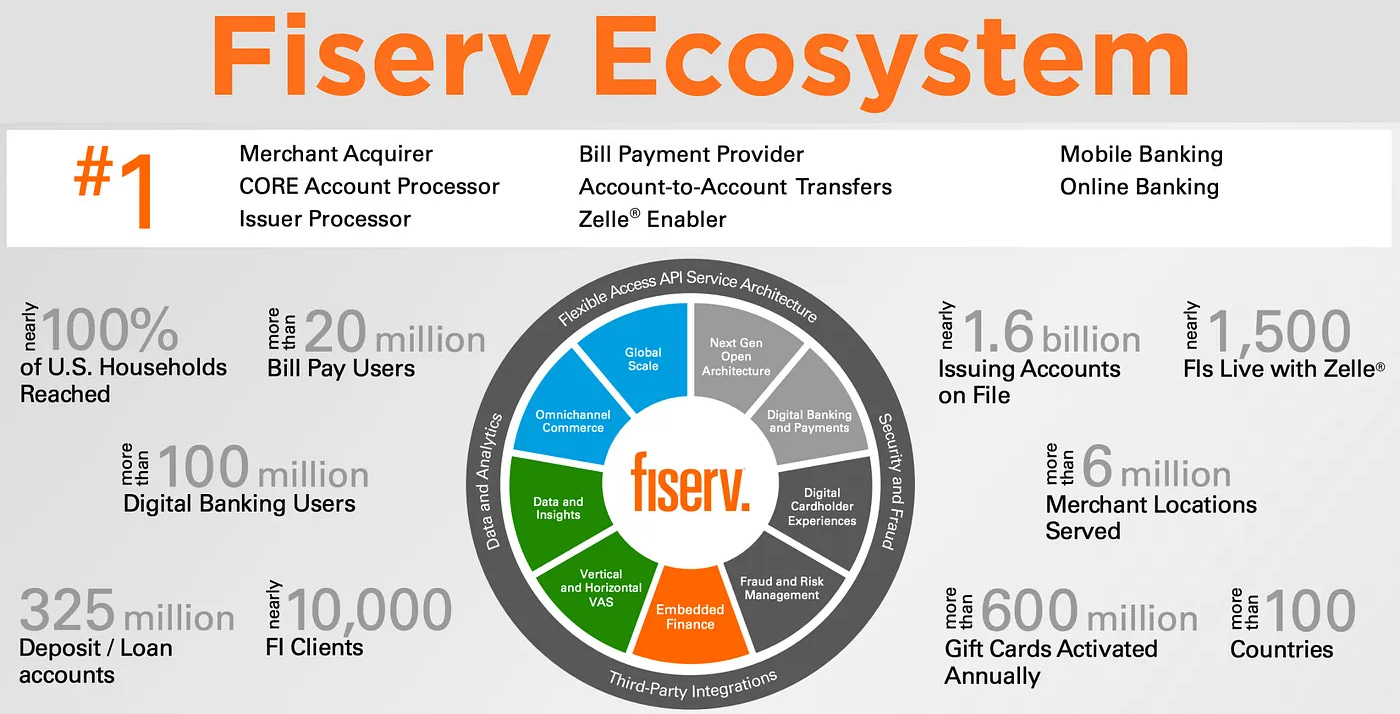

Fiserv is a global financial technology and payments infrastructure provider whose primary function is to operate behind the scenes of financial activity, enabling banks, merchants, and financial institutions to process transactions, manage customer accounts, and operate securely at scale. Unlike consumer-facing fintechs that compete on brand visibility or user engagement, Fiserv’s relevance is defined by its embedded position within mission-critical financial systems. Its platforms sit at the intersection of payments, banking operations, compliance, and data flows, making them foundational to day-to-day financial activity rather than discretionary technology spend.

This infrastructure role underpins the company’s recurring revenue base, high switching costs, and long-duration client relationships. Once integrated, Fiserv’s systems become deeply interwoven into a client’s operational and regulatory framework, making replacement costly, risky, and operationally disruptive. As a result, Fiserv functions less like a traditional software vendor and more like a utility-style enabler of financial activity. This positioning defines the company as a durability-first business, where resilience, continuity, and reliability matter more than rapid innovation cycles or consumer brand recognition.

Company History

Fiserv was founded in 1984 with a clear and pragmatic objective: to provide outsourced data processing and core banking systems to financial institutions that lacked the scale, capital, or technical expertise to build and maintain such infrastructure internally. From inception, the company focused on becoming an indispensable back-office partner, emphasizing reliability, regulatory compliance, and long-term integration rather than front-end innovation. This founding logic shaped Fiserv’s early reputation as a trusted infrastructure provider to banks and credit unions.

Over subsequent decades, Fiserv pursued a deliberately acquisition-led expansion strategy, using M&A to broaden its functional scope and deepen its role across the financial ecosystem. The company steadily added capabilities in electronic payments, bill payment, card issuing and processing, digital banking, and risk and fraud solutions. Through this process, Fiserv evolved from a narrow core processor into a diversified financial technology platform serving both financial institutions and merchants.

The most consequential inflection point in the company’s history occurred in 2019 with the acquisition of First Data. This transaction fundamentally altered Fiserv’s business mix and strategic orientation, transforming it into a major global payments and merchant acquiring player. The deal materially increased scale, expanded exposure to transaction-based revenue, and repositioned the company closer to the point of commerce. While strategically transformative, it also introduced greater operational complexity, increased exposure to competitive pricing dynamics, and raised the bar for execution. The legacy of this acquisition continues to shape Fiserv’s growth profile, margin structure, and investor perception today.

Company Philosophy

Fiserv’s operating philosophy is fundamentally infrastructure-first. The company prioritizes system stability, regulatory compliance, security, and continuity over rapid experimentation or consumer-facing visibility. Its value proposition is built on being deeply embedded in client operations, where uptime, accuracy, and resilience are non-negotiable. For its clients, failures are not inconveniences; they are operational, regulatory, and reputational risks. This reality explains Fiserv’s emphasis on long-term contracts, recurring fee structures, and platforms that are deliberately designed to be difficult to replace.

Embedded relevance is central to this philosophy. Fiserv does not compete for end-user mindshare; it competes for institutional trust. That trust is earned through reliability, scale, and regulatory competence rather than novelty. This approach creates durable relationships and predictable revenue streams, but it also imposes a structural trade-off. By design, infrastructure-first businesses tend to move more deliberately, with longer product cycles and incremental innovation rather than rapid iteration.

As the fintech landscape has evolved, this trade-off has become more visible. Faster-moving, cloud-native competitors have challenged incumbents on product velocity, modularity, and pricing. While Fiserv’s philosophy protects against sudden disruption, it also means that growth is typically incremental and execution-dependent. The company’s challenge is therefore not philosophical misalignment, but adapting an infrastructure-first model to a more competitive, modular, and price-sensitive environment without undermining the reliability that defines its moat.

Business Model Evolution

Fiserv’s business model has evolved through distinct phases, each expanding its economic exposure while increasing execution complexity. Initially, the company operated a predominantly contract-driven model, anchored in long-term service agreements with financial institutions. Revenue was highly predictable, churn was low, and exposure to macroeconomic cycles was limited. Value creation was driven by scale, client retention, and incremental service adoption rather than transaction volumes.

Over time, as payments and digital financial services grew in importance, Fiserv expanded into payments enablement and network services, layering transaction-based revenue onto its contractual base. This broadened the addressable market and introduced operating leverage, but also increased sensitivity to usage patterns and pricing dynamics.

The First Data acquisition marked the most significant evolution, shifting Fiserv decisively toward transaction-exposed revenue through merchant acquiring and commerce solutions. This tied a larger portion of growth and profitability to payment volumes, merchant activity, and competitive pricing. The upside was higher growth potential and closer proximity to commerce; the downside was increased exposure to macro cycles and competitive pressure. In this phase, scale alone became insufficient as a value driver.

Today, Fiserv is in a phase where value creation depends on execution rather than positioning. The challenge is no longer building scale, but converting scale into operating leverage, defending margins, and monetizing software and value-added services across a complex client base. This evolution explains why recent performance has been judged more harshly by the market. The company’s structural position remains strong, but its business model now requires disciplined execution to translate embedded relevance into sustainable growth, margin resilience, and free cash flow expansion.

Management & Leadership Analysis

Management credibility is a central variable in any turnaround or reset situation, and in Fiserv’s case it has become a defining factor in how the market prices risk and recovery potential. The 2025 guidance reset exposed gaps in execution, forecasting discipline, and cost responsiveness, forcing a reassessment of leadership effectiveness across the organization. As a result, the management and governance structure must now be evaluated less on historical track record and more on its ability to restore growth credibility, reestablish operating leverage, and impose capital discipline in a lower-visibility environment.

Executive Leadership

At the CEO level, the mandate is deliberately clear, narrow, and execution-centric. The current leadership framing prioritizes restoring credibility through delivery rather than ambition through vision. Management messaging has shifted away from aggressive growth narratives toward operational stabilization, margin protection, and forecast reliability. This reflects a necessary recalibration after a period in which scale, integration synergies, and financial engineering obscured emerging execution weaknesses. In the current phase, the CEO’s credibility is earned quarter by quarter, not through long-term strategic roadmaps.

The sequencing of priorities is critical. Leadership must first stabilize Merchant Solutions momentum, as this segment is both the primary growth engine and the most market-visible indicator of execution quality. In parallel, Financial Solutions must move from gradual erosion toward stabilization, even if that stabilization comes without near-term growth. Finally, cost structures must be aligned with realistic revenue trajectories, ensuring that incremental revenue once again translates into operating leverage rather than being absorbed by fixed costs. The reset lowered expectations, but it also lowered the bar for demonstrating measurable, sequential improvement, which is now the central test of leadership effectiveness.

Execution accountability has increasingly shifted to segment leadership, particularly within Merchant Solutions and Financial Solutions. Merchant Solutions leadership is judged not just on transaction volume growth, but on growth quality. This includes software and services attach rates, ecosystem monetization through platforms such as Clover, and pricing discipline in a highly competitive acquiring environment. In Financial Solutions, the leadership challenge is structurally different. Success is defined less by headline growth and more by managing decline risk, defending relevance in a modular fintech landscape, and extracting incremental value from long-standing client relationships through upgrades, compliance-driven spend, and phased modernization. Across both segments, the market is watching for evidence that leadership can convert strategy into outcomes rather than relying on embedded client inertia.

The CFO role has become central to the investment case following the 2025 reset. Capital discipline, forecasting accuracy, and free cash flow conversion are now the primary credibility metrics. Historically, Fiserv’s strong cash generation enabled aggressive buybacks that enhanced per-share value. Recent results, however, exposed the risks of capital returns that outpace earnings recovery. The finance function must now prioritize balance sheet resilience, align capital returns with sustainable free cash flow rather than leverage capacity, and restore confidence through conservative guidance and transparent communication. In the current environment, financial leadership is judged less by headline EPS growth and more by the quality, durability, and repeatability of cash flows.

Michael P. Lyons: President & Chief Executive Officer

Michael P. Lyons became President and Chief Executive Officer of Fiserv following a long career at PNC Financial Services Group, where he most recently served as President and was a key architect of the firm’s operational and strategic expansion. During his tenure at PNC, Lyons oversaw multiple major business lines, including retail banking, corporate and institutional banking, and payments-related activities, giving him direct experience managing complex, regulated financial platforms at national scale. His career at PNC was defined less by headline growth initiatives and more by disciplined balance sheet management, risk control, and execution consistency across economic cycles.

Lyons’ leadership background is firmly rooted in regulated banking and financial infrastructure, rather than venture-style fintech or consumer-facing technology. This matters materially for Fiserv’s current phase. At PNC, he operated in environments where operational failure carried regulatory, reputational, and systemic consequences, reinforcing a management style that prioritizes reliability, governance, and controllable execution over rapid experimentation. That background aligns closely with Fiserv’s role as a mission-critical infrastructure provider, where uptime, compliance, and predictability are core value drivers.

The context of Lyons’ appointment is equally important. He assumed the CEO role at a time when Fiserv had completed its major integration cycles and faced rising scrutiny over organic growth deceleration, margin pressure, and execution discipline. His mandate was not to reinvent the company’s strategy or pursue transformational acquisitions, but to re-anchor credibility, tighten execution, and ensure that operating performance, guidance, and capital allocation are aligned. The lowered guidance and operational reset that followed reflect a willingness to reset expectations rather than defend legacy narratives.

Strategically, Lyons’ approach emphasizes sequencing and realism. Stabilizing Merchant Solutions performance, arresting further erosion in Financial Solutions, and aligning the cost base with achievable revenue growth are prioritized over ambitious long-term targets. This reflects a banking-style mindset: protect the franchise first, then rebuild growth credibility incrementally. While this conservative posture may limit near-term upside narratives, it lowers execution risk and increases the probability of gradual normalization in margins and free cash flow.

In sum, Michael Lyons is not a visionary disruptor CEO, nor is he positioned as a growth evangelist. He is an operator and steward, selected to guide Fiserv through a period where execution discipline, financial realism, and credibility restoration matter more than expansionary ambition. Whether valuation re-rates will depend less on his vision and more on his ability to deliver steady, sequential improvement across the business, an outcome that is consistent with his career history and leadership profile.

Takis Georgakopoulos: Co-President, Merchant Solutions & Technology

Takis Georgakopoulos joined Fiserv through the First Data organization, where he was part of the senior leadership team responsible for scaling one of the world’s largest merchant acquiring and payments platforms. His career has been built almost entirely within the global payments ecosystem, spanning merchant acquiring, processing infrastructure, platform technology, and large-scale operations. This background gives him deep institutional knowledge of how high-volume, mission-critical payment systems operate under competitive, regulatory, and margin pressure.

Following the First Data acquisition, Georgakopoulos became a central figure in the integration and operational scaling of Fiserv’s Merchant Solutions business. His remit expanded beyond pure operations into technology strategy, platform reliability, and ecosystem development. He has been closely associated with the evolution of Fiserv’s merchant platform strategy, including the expansion and monetization of the Clover ecosystem, as well as broader initiatives to unify payments, software, and value-added services across merchant segments. His role reflects continuity rather than disruption, emphasizing execution, scale efficiency, and platform resilience.

Georgakopoulos is best characterized as an operator-technologist, not a consumer-facing product visionary. His leadership style aligns with Fiserv’s infrastructure-first philosophy, prioritizing uptime, scalability, security, and regulatory compliance over rapid experimentation. This orientation has historically supported margin stability and reliability at scale, but it also places pressure on his leadership as competitive dynamics intensify. In the current environment, his effectiveness is judged not just on maintaining volume growth, but on improving growth quality through software attach rates, ecosystem monetization, and disciplined pricing in a highly competitive merchant acquiring landscape.

As Co-President of Merchant Solutions and Technology, Georgakopoulos sits at the center of Fiserv’s growth-risk equation. Merchant Solutions is the company’s most transaction-exposed and competitive segment, making his execution critical to restoring investor confidence. The market’s assessment of Fiserv’s recovery will be closely tied to his ability to demonstrate that scale can once again translate into operating leverage, that technology investment can drive differentiation rather than cost inflation, and that Fiserv can defend relevance in merchant ecosystems without sacrificing margin discipline.

Dhivya Suryadevara: Co-President, Financial Solutions, Sales & Operations

Dhivya Suryadevara brings a rare combination of large-scale financial leadership, operational discipline, and cross-industry transformation experience to Fiserv’s Financial Solutions franchise. Prior to joining Fiserv, she served as Chief Executive Officer of Optum Financial and Optum Insight, two core divisions of UnitedHealth Group responsible for financial services, data analytics, and technology-enabled solutions across healthcare. In those roles, she oversaw complex, highly regulated platforms operating at national scale, with responsibility for profitability, technology modernization, and long-term client relationships. Her tenure at Optum was defined by an emphasis on execution, data-driven decision-making, and platform scalability rather than headline growth narratives.

Earlier in her career, Suryadevara served as Chief Financial Officer of General Motors, where she was responsible for financial strategy, capital allocation, and balance sheet management during a period of significant industry disruption and transformation. At GM, she operated in an environment characterized by high fixed costs, cyclical demand, and intense capital discipline requirements. This experience is particularly relevant to Fiserv’s current phase, where margin protection, forecasting accuracy, and disciplined capital deployment are central to restoring credibility. Her background at GM reinforced a management style grounded in realism, cost control, and operational accountability rather than financial engineering.

Within Fiserv, Suryadevara’s remit over Financial Solutions, Sales, and Operations places her at the center of the company’s most stability-oriented but structurally challenged segment. The Financial Solutions business is defined by long sales cycles, conservative client behavior, and high switching costs, requiring leadership that prioritizes reliability, modernization without disruption, and incremental value extraction over aggressive growth targets. Her prior experience running large, regulated, data-intensive platforms aligns closely with these demands, particularly as banks and financial institutions increasingly seek phased upgrades and modular adoption rather than full system replacements.

Strategically, Suryadevara’s presence signals a shift toward execution normalization and operational rigor within Financial Solutions. Her role is less about driving rapid expansion and more about arresting growth erosion, defending relevance in a modular fintech landscape, and ensuring that the segment contributes predictable cash flow and margin stability to the broader group. In the context of Fiserv’s 2025 reset, her leadership background fits the company’s recalibrated priorities: stabilizing performance, improving delivery consistency, and restoring confidence through measurable outcomes rather than aspirational targets.

Paul Todd: Chief Financial Officer

Paul Todd joined Fiserv as Chief Financial Officer with a background that is deeply rooted in large-scale payments and financial services infrastructure, bringing credibility and relevance to the company at a time when financial discipline and execution consistency became paramount. Prior to joining Fiserv, Todd served as Chief Financial Officer of Global Payments, one of the world’s largest payment technology companies, where he oversaw financial strategy, capital allocation, investor relations, and balance sheet management through multiple market cycles. His tenure there coincided with a period of significant scale expansion, M&A integration, and increasing scrutiny from public markets, giving him direct experience managing complexity under investor pressure.

Todd’s career has been shaped by environments where operating leverage, transaction-based revenue, and capital intensity are central to value creation. At Global Payments, he was closely involved in optimizing margin structures, funding acquisitions, managing leverage targets, and communicating financial priorities to institutional investors. This experience is directly transferable to Fiserv’s post–First Data reality, where execution, cash flow quality, and disciplined capital returns matter more than headline growth narratives.

Within Fiserv, Todd’s role has taken on heightened importance following the 2025 reset. The company’s prior reliance on aggressive buybacks and strong historical cash generation exposed vulnerabilities when earnings momentum softened. Todd’s mandate is therefore not growth storytelling, but restoring financial credibility. This includes improving forecasting accuracy, aligning capital returns with sustainable free cash flow rather than balance sheet capacity, protecting credit metrics, and increasing transparency around margin and cash flow dynamics. His background suggests a conservative, market-aware approach, prioritizing durability and investor trust over short-term optics.

Todd represents a stabilizing influence rather than a catalyst personality. He is not expected to drive strategic reinvention, but to enforce financial discipline, recalibrate capital allocation, and ensure that execution improvements translate into durable cash flow. In the current phase of Fiserv’s evolution, this profile is aligned with what the business requires: less financial engineering, more accountability, and a clearer linkage between operating performance and shareholder returns.

Neil H. Wilcox: Head of Corporate Social Responsibility

Neil H. Wilcox brings a deep institutional legal and governance background to Fiserv, shaped by decades of senior leadership roles across highly regulated financial services organizations. He joined Fiserv following the First Data acquisition, where he had already been involved in governance and legal oversight, providing continuity through one of the most complex integration periods in the company’s history. His career has been consistently oriented around regulatory rigor, risk management, and institutional accountability rather than commercial execution.

Prior to Fiserv, Wilcox held senior legal and governance positions at USAA and JPMorgan Chase, two institutions known for stringent regulatory oversight and conservative risk cultures. At USAA, he served as interim General Counsel, where he was responsible for navigating complex regulatory environments, overseeing legal strategy, and advising senior leadership and the board during periods of organizational transition. His experience at JPMorgan further reinforced his exposure to large-scale, systemically important financial institutions, where governance, compliance, and reputational risk management are central to enterprise stability.

At Fiserv, Wilcox’s role sits squarely within the company’s infrastructure-first philosophy. Corporate Social Responsibility is treated not as a branding exercise, but as an extension of governance, regulatory credibility, and institutional trust. His remit spans ethical conduct, compliance culture, stakeholder engagement, and alignment between corporate practices and regulatory expectations across global markets. This function is particularly relevant for Fiserv given its position as a behind-the-scenes enabler of financial activity, where reputational risk and regulatory missteps can have outsized consequences.

Wilcox is also active in board and nonprofit leadership, reinforcing his long-standing focus on institutional stewardship and public trust. His profile reflects Fiserv’s broader leadership posture: conservative, compliance-oriented, and risk-aware. While his role does not directly influence near-term revenue or margin outcomes, it contributes to the company’s long-term license to operate. In the context of Fiserv’s execution reset, Wilcox’s presence underscores management’s emphasis on governance strength, regulatory resilience, and institutional credibility as foundational pillars supporting sustainable cash flow and long-term value creation.

Executive Leadership Profile – Key Takeaway

Fiserv’s senior leadership team is operator-heavy, institutionally trained, and execution-oriented, with deep roots in banking, payments, and regulated enterprises. This is not a founder-led or product-visionary leadership group. Instead, it reflects a deliberate pivot toward operational credibility, financial discipline, and delivery consistency, aligning with Fiserv’s current phase as an infrastructure business focused on stabilization and execution normalization rather than narrative-driven growth.

Board of Directors

Fiserv’s board composition reflects a deliberate blend of financial services, payments, technology, and operational leadership experience, which is appropriate for a company operating at the intersection of banking infrastructure and global payments. The board is not constructed to champion visionary disruption or aggressive expansion narratives, but rather to oversee complex, regulated, and mission-critical systems at scale. This composition historically supported Fiserv’s acquisition-led growth and integration strategy, but notes a clear shift in emphasis following the 2025 reset.

Post-reset, the board’s role has evolved from supervising scale expansion to active governance during an execution repair phase. Skills related to risk management, capital allocation discipline, regulatory oversight, and operational accountability have become more relevant than pure growth orientation. This transition matters. When growth slows and operating leverage turns negative, governance quality becomes a decisive factor in whether a reset results in durable improvement or repeated disappointment.

The governance posture following the reset suggests a more hands-on and interventionist board stance, particularly around performance monitoring and capital discipline. This is a constructive development. The board is now expected to act as a counterbalance to management incentives that historically favored financial engineering, aggressive buybacks, or narrative-driven recovery framing. In this environment, board credibility will be judged less by independence optics and more by behavioral evidence of discipline, especially when short-term market pressure conflicts with long-term operational health.

Capital allocation oversight is one of the board’s most critical responsibilities going forward. With leverage elevated and free cash flow under pressure, the board’s willingness to moderate buybacks, prioritize balance sheet resilience, and align capital returns with sustainable cash generation will be a key signal of governance effectiveness. Similarly, compensation structures tied to operational milestones, margin stability, and cash flow quality, rather than headline EPS or stock price performance will determine whether incentives reinforce execution normalization or perpetuate short-termism.

Importantly, alignment between the board and management has shifted toward execution realism rather than optimism. The 2025 reset implicitly acknowledged that prior strategies over-relied on scale benefits and underestimated cost rigidity and competitive pressure. A board aligned with this realism increases the probability that corrective actions are sustained, rather than reversed once market sentiment improves. This alignment reduces the risk of premature re-leveraging, aggressive guidance resets, or renewed reliance on financial engineering to mask operating softness.

In sum, Fiserv’s board is transitioning from a growth-enabling body to an execution-enforcing one. This is an appropriate evolution given the company’s current phase. While governance alone cannot restore growth or margins, a disciplined, engaged board materially increases the likelihood that management actions translate into durable operational improvement rather than cyclical relief. For investors, board behavior, not composition alone, will be a key indicator of whether the reset is structural or merely cosmetic.

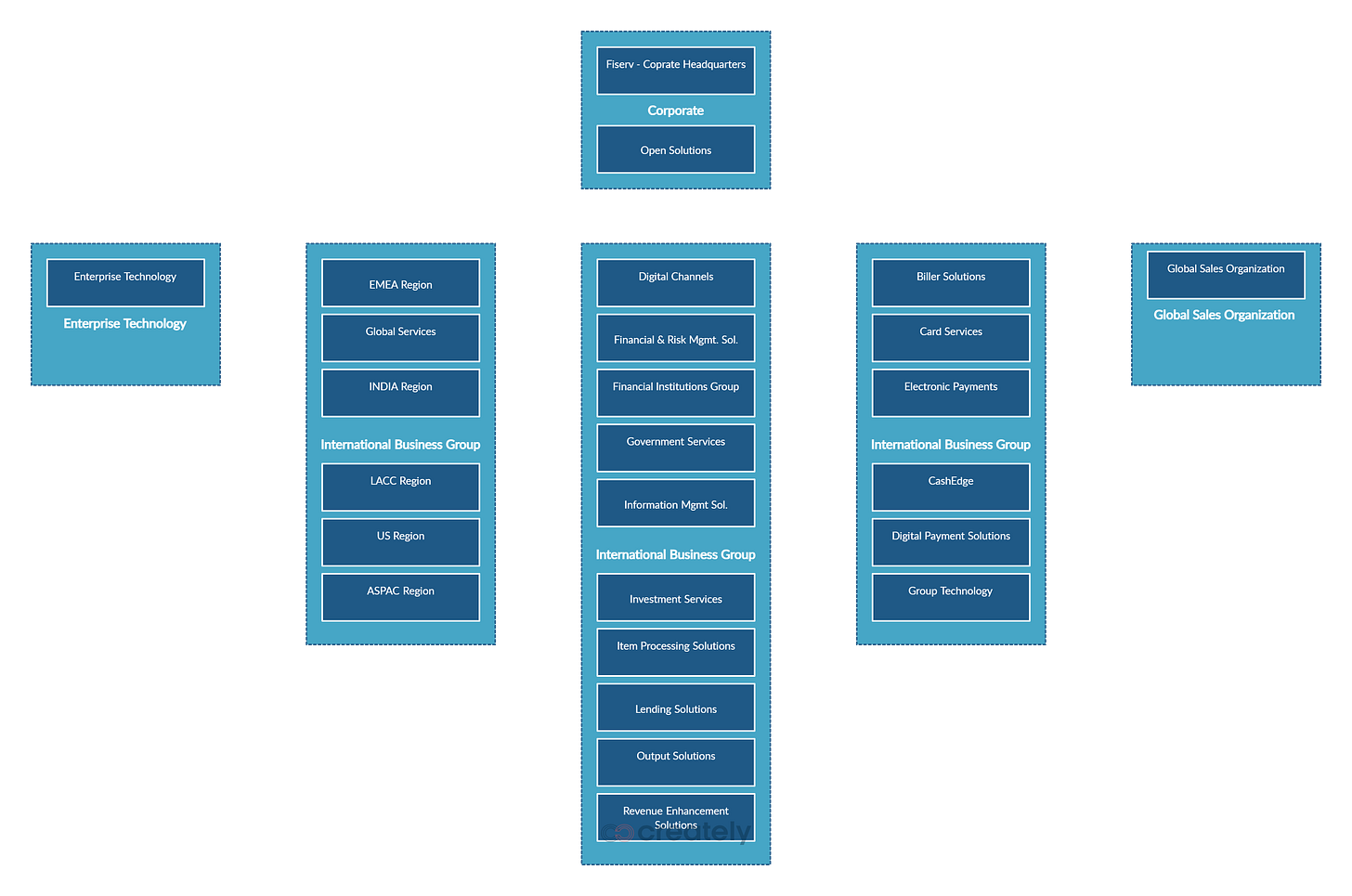

Corporate Structure

Fiserv’s corporate structure is intentionally designed to balance scale with specialization, reflecting the company’s dual identity as both a financial institution services provider and a global merchant payments platform. Segment-based organization and reporting provide necessary transparency into distinct economic drivers, but the structure also introduces operational and managerial complexity. In large infrastructure businesses like Fiserv, this complexity is manageable when growth is steady and margins are expanding, but it becomes a material risk factor during periods of execution stress, when speed, clarity, and accountability matter most.

The current structure places Merchant Solutions and Financial Solutions as the two primary operating pillars, each with fundamentally different revenue models, margin profiles, and competitive dynamics. Merchant Solutions is transaction-driven, volume-sensitive, and exposed to pricing pressure, requiring fast decision-making, commercial agility, and constant product iteration. Financial Solutions, by contrast, is contract-based, stability-oriented, and governed by long sales cycles and regulatory constraints, demanding patience, reliability, and long-term relationship management. Treating these segments under a uniform strategic or cost framework risks misalignment and suboptimal execution.

As a result, segment-level accountability is central to restoring performance credibility. Each segment must have clear ownership of results, with transparent performance metrics that tie revenue quality, margin discipline, and cash flow contribution directly to leadership incentives. Capital allocation decisions, whether incremental investment, cost containment, or prioritization of growth initiatives must increasingly be made with segment-level return profiles in mind rather than consolidated optics. Without this discipline, scale can dilute accountability, allowing underperformance to be masked by consolidated results.

The trade-off between complexity and control has therefore moved to the forefront in the post-reset environment. Fiserv’s size and breadth provide resilience, cross-selling opportunities, and distribution advantages that smaller competitors cannot easily replicate. However, these same attributes require strong internal coordination, clear prioritization, and effective communication across business lines. When decision-making is overly centralized or slowed by layered governance, the organization risks responding too slowly to competitive and macro pressures, particularly in Merchant Solutions where pricing and product dynamics evolve rapidly.

The post-reset period will test whether Fiserv’s corporate structure can support faster decision-making, sharper cost control, and clearer execution ownership without undermining the stability that defines its infrastructure role. Structural design alone is not the determining factor. What ultimately matters is whether management can operate the structure with discipline, empowering segment leaders where agility is required, enforcing accountability where margins are under pressure, and maintaining centralized oversight where risk, compliance, and capital allocation demand it. In this context, management effectiveness will be judged not by organizational charts, but by whether the existing structure delivers measurable improvements in execution, margins, and cash flow consistency.

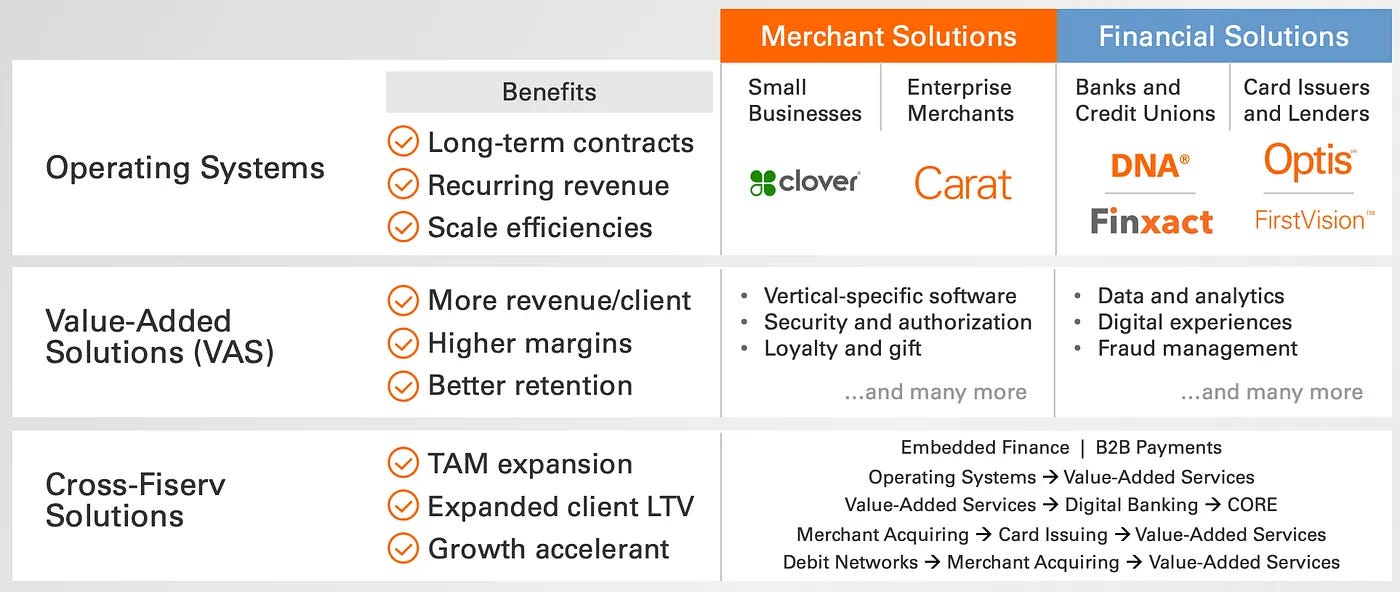

Services, Solutions & Revenue Drivers

Fiserv’s business is best understood through the lens of how it monetizes transaction flow, embedded client relationships, and incremental service adoption, rather than through headline product descriptions or individual platforms. The company is positioned at critical junctions of commerce and banking, where transactions, data, compliance, and settlement converge. By operating at these junctions, Fiserv captures recurring, usage-based revenue that is deeply embedded in client workflows and difficult to displace. This embeddedness creates high switching costs and long-duration relationships, but it also places a premium on execution and revenue quality.

At the foundation of Fiserv’s revenue model is transaction flow monetization. Across both merchant and financial institution clients, Fiserv earns fees based on the volume and value of transactions processed through its systems. In Merchant Solutions, this includes card-present and card-not-present payments, digital wallets, and omnichannel commerce activity. In Financial Solutions, transaction flow is tied to account activity, card issuing, payments, and network services. This model provides structural exposure to secular growth in electronic payments, but it also introduces sensitivity to macroeconomic conditions, consumer spending patterns, and competitive pricing dynamics. As a result, volume growth alone is not sufficient to sustain margin expansion.

The second pillar of Fiserv’s revenue model is embedded client relationships. Once Fiserv’s platforms are integrated into a bank’s core systems or a merchant’s point-of-sale and payments stack, they become operationally and regulatorily difficult to replace. This embedded position supports long-term contracts, predictable renewal behavior, and low churn, particularly in Financial Solutions. However, embeddedness can also mask underlying growth erosion if clients delay upgrades or adopt third-party modules around the core. Therefore, relationship depth must be actively monetized through continued engagement rather than passively relied upon.

Incremental service adoption is where revenue quality is determined. Fiserv’s highest-quality revenue comes not from base transaction processing, but from software, data, fraud prevention, analytics, compliance tools, and other value-added services layered on top of core platforms. These services increase revenue per client, carry higher margins, and improve cash flow conversion. In Merchant Solutions, this is reflected in software attach rates and ecosystem monetization through platforms such as Clover. In Financial Solutions, it appears in the adoption of digital banking modules, payments enhancements, and compliance-driven services. Management’s ability to drive this incremental adoption is central to restoring operating leverage.

The mix between volume-driven revenue and software-led, value-added revenue is therefore critical. Revenue growth driven primarily by transaction volume is inherently more competitive and lower margin, while growth driven by software and services supports margin expansion and valuation resilience. In recent periods, mix has been less favorable, exposing the limits of scale-based growth. Going forward, improving mix is more important than accelerating headline growth, as it directly determines incremental margins and free cash flow durability.

Fiserv’s services and solutions form a broad and resilient infrastructure layer, but value creation depends on monetization discipline rather than breadth alone. The company’s ability to translate embedded relevance into higher-quality revenue: through pricing discipline, service attach rates, and targeted investment will determine whether transaction growth results in sustainable margin expansion or simply higher volume at diminishing returns.

Merchant Solutions

Merchant Solutions is Fiserv’s most visible and economically dynamic segment, serving as the primary engine of incremental revenue growth and the focal point of investor scrutiny. The segment is anchored by merchant acquiring, payment processing, and the Clover platform, which together position Fiserv closer to the point of commerce than any other part of its business. Clover functions as an integrated operating system for small and mid-sized merchants, combining point-of-sale hardware, payment acceptance, proprietary software, and a growing third-party application marketplace. This ecosystem approach allows Fiserv to monetize merchants across multiple layers of the value chain rather than relying solely on low-margin payment processing fees.

The strategic importance of Clover lies in its ability to increase revenue per merchant and deepen switching costs. Hardware deployment establishes an initial anchor, while software subscriptions, add-on services, and app integrations expand monetization over time. This layered model improves revenue quality and supports higher margins relative to pure acquiring. However, it also raises execution expectations. Success depends on maintaining a compelling product experience, driving attach rates, and continuously expanding ecosystem functionality in an environment where competitors iterate quickly and target similar merchant segments.

Revenue in Merchant Solutions is inherently volume-sensitive, scaling with transaction counts, average ticket sizes, and overall merchant activity. In periods of economic expansion or strong consumer spending, this creates a natural growth tailwind and operating leverage. Conversely, it introduces macro and cyclical exposure that is absent in more contract-driven segments. When volumes slow or pricing pressure intensifies, margin resilience depends on how much revenue is derived from software and services rather than transaction fees alone.

Competitive pressure in merchant acquiring remains intense. The market is crowded with global processors, fintech platforms, and vertical-specific providers that compete aggressively on price, user experience, and feature velocity. In this environment, defending take rates through pricing alone is difficult. Fiserv’s competitive response relies on ecosystem depth, bank distribution, and integrated functionality, rather than undercutting on price. This places a premium on execution quality and product relevance rather than scale alone.

As a result, sustainable growth in Merchant Solutions is increasingly a function of mix rather than volume. Raw transaction growth provides baseline expansion, but long-term value creation depends on increasing software penetration, expanding services attach rates, and monetizing the Clover ecosystem more effectively. The segment’s success will therefore be judged not by headline volume growth, but by improvements in revenue quality, incremental margins, and cash flow conversion, metrics that directly determine whether Merchant Solutions can continue to serve as a durable growth engine rather than a cyclical volume business.

Financial Solutions

Financial Solutions encompasses Fiserv’s core banking systems, issuer processing platforms, digital banking solutions, and a broad suite of compliance, risk, and fraud tools sold primarily to banks and credit unions. These offerings sit at the heart of a financial institution’s daily operations, supporting deposits, lending, payments, customer engagement, and regulatory reporting. Because these systems are mission-critical, reliability, security, and regulatory compliance take precedence over rapid feature innovation, resulting in high switching costs and long-lived client relationships.

The economic profile of Financial Solutions is therefore contractual and durable. Revenue is predominantly generated through long-term service agreements, licensing arrangements, and usage-based fees tied to account and transaction activity. Client churn is structurally low, as replacing a core banking system is operationally complex, costly, and risky. This embedded position provides Fiserv with predictable cash flows and attractive margins, reinforcing the segment’s role as a stabilizing force within the broader business.

However, stability comes at the expense of growth velocity. Financial Solutions is not designed to deliver rapid acceleration. Revenue growth is driven by contract renewals, regulatory-driven upgrades, and incremental adoption of additional modules rather than frequent new client wins. Sales cycles are long, procurement decisions are conservative, and technology budgets at financial institutions are highly sensitive to macroeconomic conditions, interest rate environments, and regulatory uncertainty. During periods of economic stress or uncertainty, banks often defer large-scale technology upgrades, slowing revenue growth even as relationships remain intact.

The competitive landscape further reinforces this dynamic. While Fiserv’s incumbency and scale provide a meaningful moat, banks increasingly adopt modular and cloud-native solutions around their core systems, selectively sourcing best-of-breed functionality without committing to full platform replacements. This trend does not drive rapid displacement, but it does limit incremental wallet share expansion and reduces the pace at which revenue can grow within existing relationships.

As a result, Financial Solutions functions as a defensive anchor within Fiserv’s business model. It provides revenue visibility, margin support, and cash flow durability, but contributes less to upside valuation expansion than Merchant Solutions. From a valuation perspective, its primary role is to protect downside rather than drive upside, anchoring the business through cycles while execution in higher-growth segments determines whether consolidated performance improves.

Payments & Network Services

Payments and Network Services represent the core infrastructure layer that connects merchants, financial institutions, and payment rails across Fiserv’s ecosystem. This layer includes transaction routing and authorization, settlement and clearing, card network connectivity, automated clearing house processing, and real-time payments enablement. These services operate largely out of view, but they are essential to the functioning of both commerce and banking, forming the connective tissue that allows transactions to move securely and efficiently across the financial system.

The competitive dynamics of this layer are defined by scale, reliability, and regulatory complexity. Once built, payments and network infrastructure is difficult to replicate due to the capital investment, technical expertise, compliance burden, and operational resilience required. High uptime expectations and regulatory scrutiny create strong barriers to entry, favoring large, established providers such as Fiserv. These characteristics reinforce client dependence and support long-term relationships, particularly with financial institutions that require consistent, compliant access to payment rails.

Economically, Payments and Network Services exhibit infrastructure-like characteristics. Revenue is largely volume-driven, scaling with the number and value of transactions processed across the network. Incremental costs are relatively low once the platform is in place, which allows operating leverage to emerge during periods of rising transaction activity. However, this same structure introduces sensitivity to volume trends. Even modest slowdowns in transaction growth or shifts in mix can impact profitability, especially if pricing pressure limits the ability to offset volume softness.

Strategically, this layer underpins both Merchant Solutions and Financial Solutions, making it central to Fiserv’s consolidated margin profile and cash flow generation. While it is not always visible as a standalone growth driver, its performance materially influences overall financial outcomes. Stable or growing transaction volumes enhance operating leverage and cash flow, while volume pressure can magnify margin compression elsewhere in the business. As such, Payments and Network Services function as the foundation upon which Fiserv’s broader monetization strategy is built, reinforcing the importance of execution, scale efficiency, and volume stability across the enterprise.

Value-Added & Ancillary Services

Across all segments, Fiserv monetizes its installed client base through a broad set of value-added and ancillary services, including fraud prevention, security and identity solutions, data analytics, loyalty and rewards programs, and consulting and implementation services. These offerings are strategically important because they expand revenue per client without materially increasing acquisition costs, leveraging Fiserv’s embedded position within client operations.

Attach rates are the key driver of value creation in this layer. As clients adopt more value-added services, revenue mix shifts away from low-margin transaction processing toward higher-margin, software- and data-driven services. This improves margin quality, enhances cash flow conversion, and reduces dependence on pricing-sensitive payment volumes. In competitive merchant markets, where acquiring fees are under constant pressure, this layer represents Fiserv’s most effective lever for defending profitability.

While value-added and ancillary services typically represent a smaller share of total revenue, they disproportionately contribute to operating income and free cash flow due to their favorable margin profile and recurring nature. As a result, the success of this layer is central to Fiserv’s ability to convert scale into sustainable profitability, making it a critical focus area for execution and a key determinant of long-term valuation resilience.

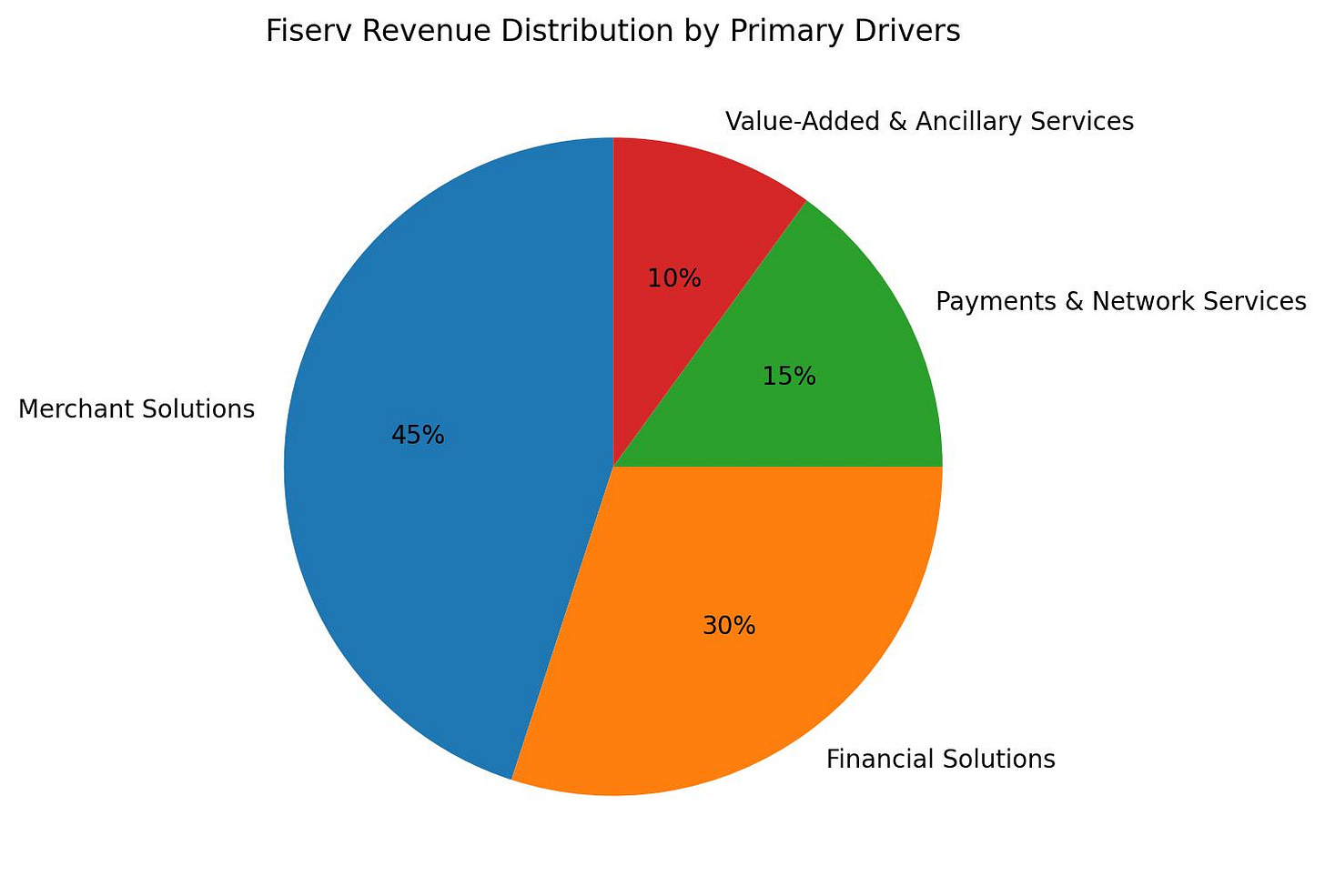

Main Revenue Drivers

Fiserv’s consolidated revenue is driven by three interrelated variables: volume, pricing, and mix. Transaction volumes determine baseline growth, particularly in Merchant Solutions and Payments. Pricing power influences take rates but is constrained by competition and long-term contracts. Product mix, however, is the most important determinant of revenue quality.

Over time, mix matters more than headline growth. Revenue growth driven by software subscriptions, data, and value-added services carries higher margins and more stable cash flow than growth driven purely by transaction volume. Fiserv’s ability to shift mix toward higher-value services through cross-selling and ecosystem expansion determines whether revenue growth translates into margin expansion and sustainable free cash flow growth. This distinction explains why periods of modest top-line growth can still create shareholder value if mix improves, and why higher headline growth can disappoint if it is low quality.

While transaction volume still accounts for the majority of Fiserv’s revenue, it is not the primary driver of value creation. Pricing is structurally constrained by competition and contracts. The real swing factor is product mix: software, data, and value-added services which determines margin expansion and free cash flow durability

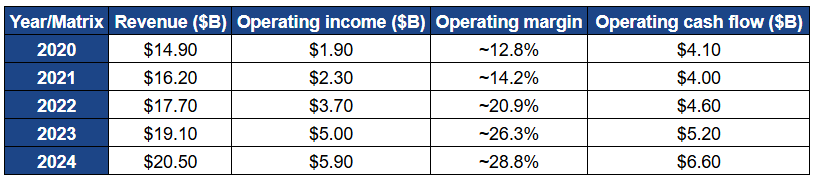

Financial Analysis

This section exists to strip away optimism, legacy reputation, and management framing, and focus squarely on what the financials are actually signaling.

For Fiserv, 2025 should not be interpreted as a routine cyclical slowdown or a temporary soft patch. It represents a mechanical inflection point, where the benefits of scale ceased to offset execution slippage, and operating leverage flipped from a structural tailwind into a material headwind.

For much of the post–First Data period, revenue growth, margin expansion, and strong cash generation created the appearance of resilience even as underlying complexity increased. In 2025, that dynamic broke down. Modest revenue deceleration translated into outsized pressure on operating income, exposing a cost structure that was less flexible than previously assumed. Incremental margins deteriorated, and earnings volatility increased, despite the absence of any demand shock or balance sheet stress. This is a critical distinction: the weakness is operational, not existential.

The financials therefore point to an execution problem rather than a business model failure. Revenue did not collapse, but margins compressed disproportionately. Cash flow remained positive, but its quality weakened as conversion relied more heavily on non-cash addbacks and working capital movements. Capital returns continued, but increasingly drew on balance sheet capacity rather than excess free cash flow. These signals collectively indicate that the company entered 2025 with less margin for error than its historical performance implied.

Viewed through this lens, the financial analysis reframes the investment debate. The question is no longer whether Fiserv is a durable infrastructure business—it is—but whether management can restore operating leverage and margin discipline within the existing model. The numbers make clear that execution normalization, not growth heroics, is what will determine whether 2025 proves to be a trough or the beginning of a lower-return regime.

2025 Reset Analysis

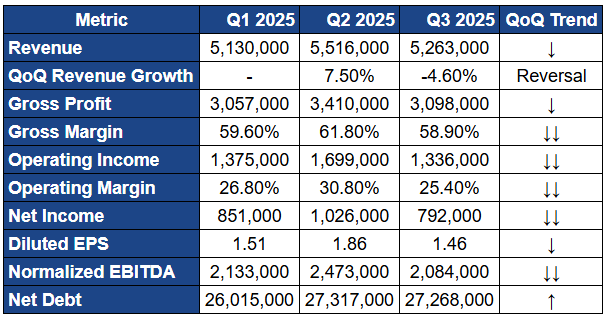

The most important signal in the 2025 financials is not the absolute revenue level, but the loss of momentum. Revenue growth slowed materially, with quarter-on-quarter progression deteriorating as the year advanced. What initially looked like normalization after a strong integration-driven period instead revealed a business that could no longer rely on baseline transaction growth and pricing to carry results. Merchant Solutions continued to grow, but not fast enough to offset softness elsewhere, while Financial Solutions showed clear signs of demand fatigue. The result was a top line that technically grew, but lost qualitative strength, undermining the assumptions embedded in prior valuation multiples.

Historically, Fiserv benefited from positive operating leverage. Incremental revenue translated efficiently into operating income as fixed costs were absorbed across a growing base. In 2025, that relationship broke. Costs continued to rise while revenue growth slowed, causing operating income to decline disproportionately. This is the defining feature of the reset. The business transitioned from a scale-driven margin expansion model to one where cost rigidity exposed earnings fragility. Once operating leverage turned negative, even small revenue disappointments produced outsized earnings pressure.

Earnings quality also deteriorated. While Fiserv remained profitable, earnings became increasingly reliant on cost addbacks, amortization adjustments, and non-core items rather than organic operating strength. Adjusted metrics masked the underlying issue: incremental profitability weakened materially. This is not a cosmetic problem. It directly impacts valuation credibility because it reduces confidence in forward earnings estimates. The reset was therefore not cosmetic or sentiment-driven. It was mathematically unavoidable once operating leverage failed.

Cash Flow Analysis

Operating Cash Flow vs Free Cash Flow

From 2020 through 2024, Fiserv’s operating cash flow consistently validated the bull case. Strong and expanding OCF translated reliably into robust free cash flow after capital expenditures, giving management ample flexibility to pursue aggressive share repurchases while managing leverage. During that period, cash generation not only supported earnings quality but also acted as a cushion that absorbed integration complexity and muted execution risk.

In 2025, that relationship weakened. Operating cash flow remained solidly positive, but it stopped compounding in line with historical trends. As earnings softened and operating leverage turned negative, incremental cash generation slowed. At the same time, capital expenditures remained elevated to support payments infrastructure, platform maintenance, and software development. The result was pressure on free cash flow, not because cash generation collapsed, but because it became more contested. The widening gap between OCF and FCF is therefore a meaningful signal: it reflects a decline in cash flow quality, not an outright deterioration in solvency.

Conversion Durability

The central issue is durability rather than absolute magnitude. Fiserv continues to generate significant cash, but conversion from revenue to free cash flow is no longer effortless. A growing portion of operating cash flow now comes from depreciation and amortization addbacks rather than incremental operating income. While this is typical for an asset- and acquisition-heavy infrastructure business, it reduces resilience in a low-growth environment where organic earnings expansion can no longer be assumed.

As a result, free cash flow must now compete more directly with interest expense, reinvestment requirements, and capital returns. The margin for error has narrowed. Cash flow remains a core strength of the business, but it is no longer an automatic stabilizer that masks execution slippage. The financials make clear that sustaining free cash flow durability going forward will require active execution discipline, including margin stabilization, cost control, and alignment of capital allocation with true cash generation rather than historical precedent.

Capital Allocation

Buybacks vs Leverage

Capital allocation is the area where the 2025 reset is most clearly exposed. Fiserv continued to execute large share repurchases throughout 2025, even as earnings momentum weakened and operating leverage turned negative. Historically, this strategy worked exceptionally well. Strong and growing free cash flow allowed buybacks to be funded organically, amplifying per-share metrics and supporting valuation without meaningfully increasing financial risk. In that environment, capital returns were a byproduct of excess cash generation.

In 2025, that dynamic changed. Buybacks increasingly leaned on balance sheet capacity rather than surplus free cash flow, altering the risk–reward profile. As earnings softened and free cash flow growth stalled, repurchases became less clearly accretive and more financially sensitive. Incremental leverage taken on to support capital returns reduced flexibility at precisely the moment when execution risk rose. The issue is not that buybacks are inherently wrong, but that their funding source matters. When repurchases are debt-assisted in a decelerating earnings environment, they magnify both upside and downside, shifting capital allocation from value creation toward risk concentration.

Balance Sheet Implications

Capital allocation is the area where the 2025 reset is most clearly exposed. Fiserv continued to execute large share repurchases throughout 2025, even as earnings momentum weakened and operating leverage turned negative. Historically, this strategy worked exceptionally well. Strong and growing free cash flow allowed buybacks to be funded organically, amplifying per-share metrics and supporting valuation without meaningfully increasing financial risk. In that environment, capital returns were a byproduct of excess cash generation.

In 2025, that dynamic changed. Buybacks increasingly leaned on balance sheet capacity rather than surplus free cash flow, altering the risk–reward profile. As earnings softened and free cash flow growth stalled, repurchases became less clearly accretive and more financially sensitive. Incremental leverage taken on to support capital returns reduced flexibility at precisely the moment when execution risk rose. The issue is not that buybacks are inherently wrong, but that their funding source matters. When repurchases are debt-assisted in a decelerating earnings environment, they magnify both upside and downside, shifting capital allocation from value creation toward risk concentration.

Margins & Operating Leverage

Incremental Margin Trends

The most damaging financial development in 2025 was the collapse of incremental margins. Revenue growth, where it existed, no longer translated into proportional profitability. In Merchant Solutions, incremental volume growth was increasingly offset by competitive pricing pressure and higher servicing costs, limiting the ability to capture operating leverage. In Financial Solutions, revenue softness and delayed upgrades meant that fixed costs were spread over a slower-growing base, further dragging consolidated margins. As a result, each additional dollar of revenue generated materially less operating income than in prior years, breaking the compounding dynamic that historically underpinned the investment case.

This shift is critical because Fiserv’s valuation has long relied on the assumption that modest revenue growth could drive outsized earnings expansion through operating leverage. The 2025 results directly challenged that assumption. Incremental margins turned negative in certain areas, and consolidated operating income became far more sensitive to small changes in revenue. This erosion of incremental profitability undermined confidence in the company’s ability to scale efficiently and exposed the limits of relying on scale alone as a margin defense.

Structural vs Cyclical Pressure

Not all margin pressure is created equal, and distinguishing between cyclical and structural forces is essential. Some of the pressure observed in 2025 is cyclical, tied to macroeconomic uncertainty, normalization in transaction volumes, and cautious spending behavior among merchants and financial institutions. These headwinds can ease over time as conditions stabilize.

However, the financials also reveal structural margin pressure that will not resolve on its own. Cost rigidity within the organization, elevated operating expenses relative to revenue growth, and sustained competitive intensity, particularly in merchant acquiring have reset the baseline level of profitability. These factors limit the degree to which margins can rebound automatically with modest revenue improvement. Without intervention, incremental revenue risks being absorbed by fixed costs and pricing pressure rather than flowing through to operating income.

This distinction matters because it defines the path forward. Cyclical pressure can be waited out; structural pressure demands action. For Fiserv, margin recovery will require explicit cost discipline, improved revenue mix toward higher-margin software and services, and the restoration of positive incremental leverage. Until these levers are pulled and evidenced in the financials, margins should be viewed as fragile rather than self-correcting, reinforcing the importance of execution over optimism.

Section Takeaway

The 2025 reset was not optional. It was the inevitable outcome of revenue deceleration colliding with a cost base built for higher growth. Fiserv remains profitable and cash generative, but the financials clearly show that scale alone is no longer sufficient. The business has entered a phase where execution quality determines outcomes. This reality check is precisely why valuation is now asymmetrical: expectations have been reset lower, but the underlying infrastructure remains intact. The next phase depends entirely on whether management can convert stabilization into renewed operating leverage.

Credit, Liquidity & Balance Sheet

Fiserv’s balance sheet risk is frequently misunderstood because headline leverage metrics are viewed in isolation rather than in the context of cash flow durability and business criticality. The company does carry a meaningful absolute debt load, but the nature of its revenues, the maturity profile of its obligations, and its continued ability to generate substantial operating cash flow materially change the risk assessment. The downside case for Fiserv is not one of solvency or liquidity stress, but one of valuation compression driven by prolonged stagnation and weaker operating leverage.

From a net debt trajectory perspective, Fiserv entered 2025 with elevated but manageable leverage following years of aggressive capital returns. Net debt increased modestly through 2025, driven primarily by continued share repurchases executed during a period of earnings deceleration rather than by operating losses or liquidity strain. Importantly, debt maturities are largely long-dated, and the company retains consistent access to capital markets. Interest expense has risen, but coverage remains supported by operating cash flow. The issue is therefore not the ability to service debt, but the opportunity cost of leverage if earnings growth fails to recover. In other words, leverage magnifies execution outcomes, but it does not threaten the company’s viability.

Liquidity remains adequate, though less conservative than in prior years. Fiserv maintains sufficient cash balances and committed revolving credit facilities to meet near-term obligations and operational needs. Working capital dynamics improved modestly during the year, providing incremental liquidity support. However, liquidity strength increasingly depends on recurring cash inflows rather than excess balance sheet cash. This reinforces the importance of restoring operating momentum, as liquidity resilience is strongest when supported by growing free cash flow rather than balance sheet management alone.

The more nuanced issue is equity quality, not debt sustainability. Fiserv’s tangible book value is deeply negative due to its acquisition-driven history, with goodwill and intangible assets comprising a substantial portion of the balance sheet. This means the equity has no asset-based downside protection. Shareholder value is entirely a function of future cash flow expectations rather than liquidation value. While this is not unusual for a scaled payments and financial infrastructure company, it does heighten sensitivity to changes in growth and margin outlook. When execution falters, equity reprices quickly because there is no tangible buffer to absorb uncertainty.

Despite these characteristics, solvency is not the issue. Fiserv is not facing refinancing pressure, covenant stress, or liquidity shortfalls. The business remains solidly profitable and cash generative, with mission-critical services that clients cannot easily replace. The real risk lies in how capital structure interacts with execution. If revenue growth remains subdued and operating leverage fails to recover, leverage limits upside and constrains capital allocation flexibility. Conversely, even modest improvement in growth and margins allows cash flow to rapidly reassert balance sheet strength.

In summary, Fiserv’s balance sheet should be viewed as a risk amplifier, not a failure point. The company’s credit and liquidity position provide sufficient runway to execute a recovery, but they do not provide immunity from valuation pressure if execution disappoints. This distinction is critical. The downside case is prolonged stagnation and muted equity returns, not insolvency. As such, the balance sheet reframes risk away from survival and toward execution credibility, reinforcing why operational proof points matter far more than headline leverage metrics in assessing Fiserv’s investment outlook.

Valuation Analysis

Valuation is the core of the Fiserv investment case, because the current market price reflects a pessimistic interpretation of recent execution issues rather than a realistic assessment of long-term cash flow durability. The stock is no longer priced as a dependable compounder, but it is also not priced as a distressed or structurally impaired business. This creates a narrow but meaningful valuation window where small changes in execution outcomes drive large changes in equity value. Understanding that convexity requires a framework that prioritizes cash flow, incremental margins, and scenario dispersion rather than headline multiples.

Valuation Framework

Fiserv is best valued through a discounted cash flow framework, not traditional multiple-based approaches. The reason is structural. The company has deeply negative tangible book value, a balance sheet dominated by goodwill and intangibles, and a business model built on embedded infrastructure rather than recoverable assets. Book value, tangible equity, and asset-based metrics provide no meaningful valuation anchor. Equity value exists entirely as a residual claim on future cash flows.

Multiples are also inadequate in isolation. Forward P/E or EV/EBITDA ratios compress sharply during periods of execution weakness, but they fail to capture how sensitive Fiserv’s earnings are to incremental revenue and margin changes. A one-point change in organic growth or operating margin has an outsized impact on free cash flow and terminal value, which multiples obscure. As a result, relative valuation can explain how the market is pricing risk, but not whether that pricing is justified.

The DCF framework used here is intentionally conservative. It applies a stable cost of capital, modest terminal growth assumptions, and explicitly models operating leverage behavior rather than assuming linear margin expansion. The objective is not to engineer upside through aggressive assumptions, but to identify how much execution improvement is required to justify higher equity value. Key sensitivities are revenue growth, incremental margins, and free cash flow conversion. Balance sheet solvency is not a sensitivity; Fiserv remains firmly solvent across all modeled scenarios.

Scenario Analysis

Given the dispersion of plausible outcomes, valuation is framed across three scenarios: bear, base, and bull. These scenarios differ primarily in growth credibility and operating leverage, not in capital structure or existential risk.

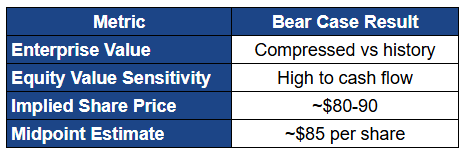

In the bear scenario, Fiserv remains stuck in a low-growth regime. Organic revenue growth hovers around 1-2% as Financial Solutions continues to weigh on consolidated results and Merchant Solutions fails to meaningfully reaccelerate. Cost rigidity persists, incremental margins remain weak or negative, and free cash flow growth stalls. Importantly, the business remains profitable and cash-generative, but it loses its ability to compound. This scenario reflects stagnation rather than collapse.

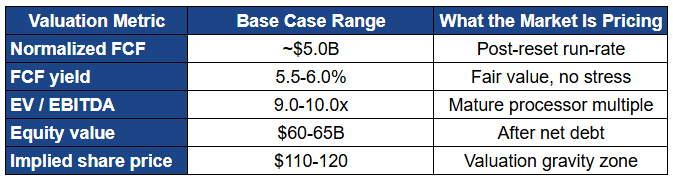

The base scenario assumes stabilization. Merchant Solutions delivers steady, low-to-mid single-digit growth, Financial Solutions bottoms out, and management regains cost control sufficient to halt margin compression. Organic growth recovers into the 3-4% range, operating margins stabilize, and free cash flow grows roughly in line with revenue. This outcome restores predictability but not momentum. It represents a mature infrastructure profile rather than a growth platform.

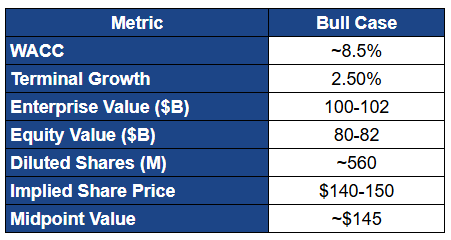

The bull scenario assumes execution recovery. Merchant Solutions reaccelerates through improved product adoption and mix, Financial Solutions stabilizes and begins contributing incremental growth, and operating leverage returns as fixed costs are absorbed more efficiently. Organic revenue growth returns to the 5-6% range, margins expand modestly, and free cash flow growth outpaces revenue. This is not a heroic scenario; it represents a return to execution standards Fiserv has demonstrated in prior cycles.

DCF with Implied Share Prices

Under the bear case, discounted cash flow analysis supports an enterprise value in the mid-$60 billions. After deducting net debt, equity value falls into the mid-$40 billions, implying a share price in the $80-90 range. This reflects a business that remains viable but structurally ex-growth, with limited justification for valuation expansion.

The base case DCF produces an enterprise value in the low-to-mid $80 billions. After adjusting for net debt, implied equity value is approximately $60-65 billion, translating to a $110-120 per share range. This aligns closely with where the market attempts to price Fiserv today, assuming stabilization but demanding proof before underwriting improvement.

In the bull case, the DCF supports an enterprise value of approximately $100-102 billion. After deducting net debt of roughly $20-21 billion, implied equity value reaches $80-82 billion. Dividing by approximately 560 million diluted shares results in an implied share price of $140-150, with a midpoint near $145. This upside is driven by higher near-term free cash flows and a more durable terminal profile, not by aggressive multiple expansion or speculative assumptions.

Scenario Summary

Across all scenarios, the dominant valuation drivers are revenue growth credibility and incremental margins, not balance sheet solvency. Downside risk is defined by stagnation and negative operating leverage rather than financial distress. Upside is unlocked by restoring modest growth and converting that growth into operating profit and free cash flow.

The market is currently pricing Fiserv as if the bear and base cases are far more likely than the bull case, assigning limited probability to execution recovery. This creates the asymmetry in the investment. Fiserv does not need to become a high-growth fintech to justify higher valuation. It only needs to prove that growth and operating leverage can normalize. Until that proof emerges, valuation should be approached with discipline. But once it does, the re-rating potential is meaningful.

In short, what moves valuation is not narrative, scale, or history, but execution at the margin. Growth plus incremental margins matter most, and the DCF framework makes that reality explicit.

Competitive Landscape

Fiserv operates in competitive environments that are often misunderstood by the market. The true risks are rarely headline disruptors or sudden displacement. Instead, competition manifests through pricing pressure, product velocity, and gradual erosion of wallet share. Separating noise from real threats requires analyzing Merchant Solutions and Financial Solutions independently, then understanding how strategic trade-offs shape long-term outcomes.

Merchant Solutions: Price Pressure vs Ecosystem Depth

In Merchant Solutions, competition is intense, visible, and unforgiving. Fiserv competes with Global Payments, Block (Square), Adyen, Stripe, Toast, and Worldpay in a market where pricing pressure is constant and differentiation is narrow. Payment processing itself has become commoditized, with merchants increasingly viewing basic acceptance as interchangeable. This caps take rates and forces competitors to compete on software, integration, and ecosystem value rather than transaction fees alone.

Fiserv’s primary defense in this environment is ecosystem depth, most notably through the Clover platform. Clover differentiates by bundling hardware, payments, software, and third-party applications into an integrated merchant operating system distributed through both direct channels and bank partnerships. This ecosystem creates switching friction and supports higher attach rates for software and value-added services, which are critical for margin quality. However, ecosystem depth is only a moat if it continues to deliver tangible value. Competitors with faster product iteration cycles and vertical-specific solutions can still win share, particularly among new merchants and digitally native businesses.

The real competitive risk in Merchant Solutions is not losing merchants outright, but margin compression through pricing competition and mix deterioration. If incremental growth comes primarily from lower-margin transactions rather than higher-value software and services, revenue growth can persist while profitability erodes. This dynamic explains why Merchant Solutions can appear healthy on the surface while contributing to negative operating leverage beneath it.

Financial Solutions: Entrenchment, Switching Costs, and Modular Risk

In Financial Solutions, competition is far more entrenched and slower moving. Core processing and digital banking platforms are deeply embedded within banks and credit unions, touching deposits, lending, payments, compliance, and customer data. Switching costs are high, implementation risk is material, and regulatory oversight discourages frequent system changes. As a result, incumbents such as Fiserv, FIS, and Jack Henry retain strong client retention and long contract durations.

Fiserv’s competitive advantage in this segment lies in scale, reliability, and institutional trust. Its platforms are proven, compliant, and deeply integrated, making them difficult to replace wholesale. This creates revenue stability and limits the risk of sudden displacement. However, stability should not be confused with growth. Financial institutions are increasingly budget-constrained and cautious, leading to longer sales cycles and delayed upgrade decisions.

The more subtle but increasingly important risk is modular encroachment. Cloud-native and best-of-breed providers allow banks to modernize specific functions, such as digital onboarding, payments orchestration, or analytics, without replacing the core system. Over time, this reduces the need for full-stack platform upgrades and limits wallet share expansion for incumbents. Fiserv may retain the core relationship, but incremental growth opportunities shrink as clients assemble hybrid technology stacks around legacy cores.

Strategic Commentary: Why Displacement Is Slow but Erosion Is Real

Across both segments, the defining competitive dynamic for Fiserv is that displacement is slow, but erosion is real. The company is unlikely to lose its position abruptly. High switching costs, regulatory complexity, and mission-critical infrastructure roles protect against sudden disruption. However, these same factors allow competitive pressures to accumulate quietly over time.