Uber Technologies (NYSE: UBER): From Disruption to Discipline

A global mobility and local-commerce platform entering a cash-flow-compounding phase, with autonomy as asymmetric optionality and capital allocation as the core value driver

Foreword From Alpha Talon

At Alpha Talon, Uber is regarded as a core holding within our long-term exposure to technology platforms and autonomous driving as structural investment themes. While Uber continues to face meaningful near-term challenges across regulation, competition, and macro conditions, we believe the company is not only capable of navigating this complex landscape, but positioned to emerge stronger. In our view, Uber is on track to solidify its role as a global leader within its respective industry, supported by scale, platform economics, and disciplined execution.

Our conviction in Uber is exceptionally high. That conviction is not based on narrative or optimism, but on conservative assumptions, rigorous financial analysis, and a clear-eyed assessment of both risks and mitigants. This report reflects that discipline. We have deliberately avoided heroic projections, treated autonomy as optional upside rather than a dependency, and anchored our valuation in cash flow durability and capital allocation quality. The result is a thesis we believe is robust across cycles and resilient to adverse outcomes.

This Substack analysis is made available to free subscribers and is intended as the foundation of our broader Uber coverage. It provides the strategic, financial, and valuation framework that underpins our investment view. For paid subscribers, this analysis serves as an entry point to our full 69-page Uber report, which follows at the conclusion of this post and goes significantly deeper into modeling assumptions, scenario analysis, competitive dynamics, and long-term upside pathways.

For readers who wish to fully engage with our highest-conviction ideas and access comprehensive, institutional-grade research, we invite you to consider becoming a paid subscriber.

Executive Summary

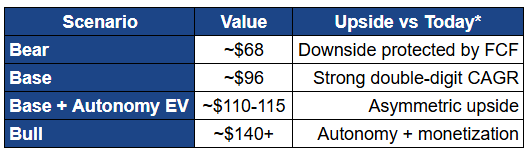

Alpha Talon views Uber as a core long-term holding within our technology platform and autonomous driving investment themes. Based on a disciplined, probability-weighted valuation framework anchored in free cash flow durability, we assign a price target of approximately $140 per share over a 5 year investment horizon. This valuation is supported by Uber’s existing base business and does not rely on autonomy for justification. Current pricing offers an attractive risk–reward profile, particularly during periods of market volatility.

Uber’s investment case rests on a small number of clear, defensible pillars.

First, mobility has emerged as a structurally profitable core, benefiting from scale, utilization, and pricing discipline, and now serves as a reliable cash flow engine. Second, Uber’s platform model creates operating leverage across mobility, delivery, and incremental monetization layers, allowing margins and free cash flow to compound without proportional capital investment.

Third, capital allocation discipline has fundamentally changed the per-share economics, with free cash flow funding buybacks and balance sheet risk largely eliminated. Finally, autonomy represents upside optionality rather than a dependency, preserving asymmetric return potential without introducing fragility into the base case.

The market continues to anchor Uber to its historical identity as a cash-burning, regulation-sensitive disruptor. This framing is outdated. Uber today is a free-cash-flow generative platform with improving margins, declining leverage, and a shareholder-return mandate. Consensus often underestimates the durability of mobility economics, overstates the long-term drag from delivery, and misprices autonomy as either an existential threat or a speculative necessity. In reality, Uber’s base business already works, and autonomy simply widens the upside distribution rather than defining the thesis.

Uber is at an inflection point where execution has overtaken narrative. Free cash flow is now structural, not cyclical. Buybacks are active, not aspirational. Margins are expanding without subsidy dependence. At the same time, market sentiment remains cautious, shaped by legacy perceptions and near-term noise around regulation and competition. This disconnect creates an opportunity to accumulate a high-quality platform business before the market fully reprices Uber as a mature compounder rather than a speculative growth asset.

Downside risk is materially lower than in prior cycles. Uber’s variable cost structure, pricing flexibility, and geographic diversification allow it to absorb regulatory, competitive, or macro shocks without threatening solvency or liquidity. Even in conservative scenarios, Uber remains free-cash-flow positive, with a strong balance sheet and no reliance on external financing. These characteristics place a natural floor under valuation and limit the probability of permanent capital impairment.

Autonomy is treated strictly as non-core optionality. Uber does not need autonomous vehicles to succeed, but is well positioned to benefit if and when they scale economically. By pursuing an asset-light, partner-led strategy, Uber avoids capital intensity and technological lock-in while maximizing the probability of participation. This optionality adds asymmetric upside to valuation without increasing downside risk, and should be viewed as a free call option layered on top of an already viable business.

In sum, Uber today is a structurally stronger, cash-compounding platform than the market often recognizes. The base business justifies investment on its own merits, while optionality enhances returns rather than carrying them. This combination underpins our high-conviction, long-term view.

Investment Thesis Framework

Uber’s investment case is best understood as a structural transition rather than a cyclical recovery. The company has evolved from a capital-consuming disruptor into a disciplined, free-cash-flow generative platform with improving margins and a shareholder-aligned operating model. This section lays out the intellectual foundation of the thesis by identifying the core drivers of value, clarifying what Uber is no longer, and explaining where market perception remains misaligned with reality.

Thesis Pillars

1. Mobility as a durable profit engine

Mobility is the economic core of Uber’s platform and the primary source of operating profit and free cash flow. The segment benefits from high utilization, strong network effects, and structurally superior unit economics relative to delivery and freight. As trip volumes scale, incremental revenue flows through at attractive margins because platform technology, corporate overhead, and fixed costs do not grow proportionally. Pricing discipline and improved matching efficiency have further reinforced mobility’s profitability, allowing Uber to generate sustainable cash flow even in the absence of aggressive growth. This durability makes mobility the stabilizing anchor of the entire business.

2. Platform leverage across verticals

Uber’s value extends beyond individual segments because it operates as a multi-vertical platform rather than a collection of standalone businesses. Mobility, delivery, and emerging monetization layers share users, data, technology infrastructure, and brand equity. This allows Uber to amortize customer acquisition costs, engineering investment, and corporate expenses across multiple revenue streams. Cross-platform engagement increases lifetime value per user and reduces reliance on subsidies to drive growth. Over time, this platform leverage has enabled Uber to compete more rationally than single-vertical peers, particularly in delivery, where economics are structurally thinner.

3. Autonomy as upside, not dependency

Autonomy represents asymmetric optionality rather than a foundational requirement for Uber’s success. The base business is already profitable and cash-generative under a human-driven model. Uber’s decision to pursue a partner-led, asset-light approach to autonomy preserves exposure to future margin upside without burdening the balance sheet or introducing binary execution risk. This positioning ensures that autonomy can enhance returns if it materializes, but does not impair the investment case if it remains delayed or limited in scope.

What Uber Is Not Anymore

Uber is no longer a growth-at-all-costs company. Management has demonstrated a clear willingness to exit unprofitable markets, reduce incentive intensity, and prioritize contribution margins over gross bookings. Growth today is pursued only where it improves long-term economics rather than inflating top-line metrics.

Uber is also no longer autonomy-dependent. The company’s valuation and cash flow profile do not rely on self-driving vehicles becoming commercially viable in the near term. This removes a significant source of historical uncertainty and lowers the risk profile of the equity.

Finally, Uber is not subsidy-driven. While incentives remain a tactical tool, they are no longer the primary mechanism for sustaining demand or supply. Pricing power, utilization, and platform efficiency now play a larger role in driving engagement, reflecting a more rational and sustainable operating model.

Variant Perception

Market consensus remains anchored to an outdated view of Uber as a structurally low-margin, perpetually competitive business that requires constant capital infusion to survive. This perception is shaped by Uber’s pre-2022 history of cash burn, regulatory battles, and aggressive expansion, and it continues to influence valuation frameworks that emphasize revenue growth over cash flow quality.

This anchor is increasingly incorrect. Uber has demonstrated sustained free cash flow generation, margin stability, and disciplined capital allocation. The balance sheet has been de-risked, and the business can now self-fund growth and shareholder returns. While competition and regulation remain real, they affect the slope of margin expansion rather than the viability of the model. The market’s failure to fully internalize this shift creates a valuation gap between Uber’s current fundamentals and its perceived risk profile.

In essence, the variant view is that Uber should be analyzed not as a speculative platform awaiting its business model, but as an operating company that has already found it.

Company Overview & Business Evolution (Condensed)

This section provides context for how Uber makes money today and how the company evolved into its current form. The objective is not to revisit Uber’s full history, but to explain why the business model is now structurally different, more disciplined, and investable at scale.

Business Model Today

Uber operates a global, multi-sided marketplace that connects consumers with independent drivers, couriers, merchants, and enterprise customers through a unified technology platform. The core economic function of the platform is demand aggregation and supply matching at scale, with pricing dynamically adjusted to balance utilization, wait times, and earnings opportunities across geographies. Uber does not own vehicles, employ drivers at scale, or operate physical infrastructure, which allows it to grow transaction volumes without proportional capital investment.

Revenue is generated primarily through a take-rate model, where Uber earns a percentage of gross bookings rather than assuming full fare or order economics. This structure allows Uber to scale revenue in line with usage while preserving flexibility in pricing and incentives. Take rates vary by product and region, reflecting differences in regulatory environments, competitive intensity, and service complexity, but the underlying logic remains consistent. As utilization improves and incentives normalize, incremental transactions contribute disproportionately to profitability, creating operating leverage at the platform level.

Uber’s asset-light design is central to its economics. Technology, data infrastructure, and centralized corporate functions represent the majority of fixed costs, while fulfillment and supply-side expenses are largely variable. This enables Uber to absorb demand volatility, adjust incentives dynamically, and maintain strong cash conversion once scale is achieved. The model is not immune to margin pressure, but it is structurally resilient and capital efficient relative to asset-heavy transportation or logistics businesses.

Strategic Evolution

Uber’s strategic evolution can be divided into a clear transition from founder-led expansion to institutionally managed execution. In its early years, Uber prioritized rapid market entry, aggressive subsidy deployment, and global footprint expansion, often at the expense of profitability and capital efficiency. This phase established brand dominance and network scale, but left the business exposed to regulatory risk, cash burn, and investor skepticism.

Under institutional leadership, Uber deliberately reset its strategy. The company exited or rationalized underperforming geographies, focused resources on markets where scale economics were achievable, and reduced tolerance for unprofitable growth. This geographic rationalization improved capital efficiency and reduced operational complexity, allowing management to concentrate on margin improvement and cash flow generation rather than headline expansion.

Most importantly, Uber implemented a capital discipline reset. Incentive intensity was reduced, speculative investments were curtailed, and large capital-intensive bets such as in-house autonomous vehicle development were abandoned in favor of partnerships. Free cash flow generation became a core objective rather than a long-term aspiration. As a result, Uber transitioned from a growth narrative driven by optionality to a platform defined by execution, operating leverage, and shareholder-aligned capital allocation.

Today’s Uber is the product of that evolution. It remains a large, global marketplace, but it is now run with financial discipline, strategic selectivity, and a clear focus on per-share value creation rather than scale for its own sake.

Management & Governance Quality

Management quality and governance discipline are central to Uber’s long-term investment case, not peripheral considerations. Uber operates in a complex, highly regulated, and operationally demanding environment, where execution mistakes directly translate into margin compression, regulatory setbacks, or capital misallocation. For institutional investors, confidence in management’s ability to allocate capital, manage risk, and compound value over time is as important as confidence in the underlying business model.

CEO & Operator Credibility

Dara Khosrowshahi’s tenure as Chief Executive Officer marks a clear break from Uber’s founder-led, disruption-first era. His value to Uber lies not in visionary product creation, but in disciplined execution and capital allocation. Since assuming leadership, Khosrowshahi has systematically shifted Uber away from growth at any cost toward a framework defined by profitability, free cash flow generation, and balance sheet resilience. This transition required difficult decisions, including exiting unprofitable markets, winding down capital-intensive initiatives, and resetting internal incentives around margin discipline rather than gross bookings growth.

Khosrowshahi’s background as a former CEO of Expedia and CFO at IAC is particularly relevant. He brings a capital markets and operating mindset well suited to managing a scaled, global platform business. Under his leadership, Uber has demonstrated pricing discipline, reduced reliance on subsidies, and established a credible capital return program. Importantly, his approach to autonomy reflects restraint rather than ambition, positioning Uber to benefit from technological progress without assuming disproportionate execution or capital risk. For long-term investors, Khosrowshahi’s credibility rests on consistency rather than charisma, a trait that materially lowers governance risk.

Management Bench Strength

Uber’s executive bench reflects a deliberate emphasis on operational depth and functional specialization. The reinstatement of a President and Chief Operating Officer role underscores the company’s focus on execution across mobility, delivery, and emerging services. The COO function is structured to ensure day-to-day operational rigor, regional coordination, and cross-segment efficiency, reducing reliance on centralized decision-making and improving responsiveness to local market conditions.

The Chief Financial Officer plays a central role in reinforcing Uber’s financial discipline. With deep experience across industrial and technology businesses, the CFO has been instrumental in strengthening cost controls, improving cash flow visibility, and aligning capital allocation with long-term shareholder value. This financial leadership has been critical in Uber’s transition to sustained free cash flow and supports investor confidence in forward projections.

Product and technology leadership further strengthen Uber’s execution capability. The Chief Product Officer oversees platform integration across mobility and delivery, ensuring that innovation is focused on monetization, efficiency, and user experience rather than experimental expansion. Technology leadership emphasizes reliability, scalability, and data-driven optimization, which are essential for a marketplace operating at Uber’s scale. In autonomy, leadership is intentionally oriented toward partnerships and commercialization readiness rather than in-house development, reinforcing the company’s asset-light strategy and limiting downside risk.

Collectively, Uber’s management bench reflects a mature operating organization rather than a founder-centric structure, reducing key-person risk and improving execution consistency.

Board Composition & Incentives

Uber’s board composition provides meaningful regulatory, capital markets, and operational credibility. Directors bring experience from heavily regulated industries, global consumer platforms, defense, financial services, and large-scale technology companies. This diversity is particularly important for Uber, given its exposure to labor regulation, public policy scrutiny, and geopolitical complexity. Board-level regulatory experience enhances Uber’s ability to anticipate policy shifts and engage constructively with governments, reducing the likelihood of disruptive outcomes.

Capital markets competence is another defining feature of Uber’s board. Directors with backgrounds in public company leadership and investment management reinforce discipline around capital allocation, balance sheet management, and shareholder returns. This influence is evident in Uber’s cautious approach to leverage, its preference for buybacks over speculative acquisitions, and its resistance to capital-intensive vertical integration.

Shareholder alignment has improved materially in recent years. Executive incentives are increasingly tied to profitability, cash flow, and return metrics rather than purely top-line growth. This alignment reduces the risk of value-destructive expansion and supports a long-term compounding framework. For institutional investors, the combination of an execution-focused CEO, a deep operating bench, and a credible, independent board materially lowers governance risk and strengthens confidence in Uber as a long-duration holding.

In sum, Uber’s management and governance structure has matured into one suitable for a scaled, cash-generative platform. This evolution is a critical but often underappreciated pillar of the investment thesis, and one that materially differentiates Uber today from its earlier incarnations.

Corporate Structure & Platform Architecture

Uber’s ability to scale globally without proportional increases in operational complexity, capital intensity, or balance sheet risk is rooted in its corporate structure and platform architecture. Unlike traditional transportation or logistics companies that scale through asset accumulation and local ownership, Uber scales through centralized control of intellectual property, capital, and data, combined with decentralized market-level execution. This design allows Uber to expand volume, geography, and services while maintaining flexibility, cost discipline, and risk containment.

Holding Company Design

Uber operates as a centralized holding company that owns and controls the core intellectual property, technology stack, capital allocation, and strategic decision-making for the entire platform. All critical assets such as the dispatch algorithms, pricing systems, payments infrastructure, data analytics, and safety frameworks are developed and governed centrally. This ensures consistency, rapid iteration, and global scalability without duplicative investment across regions or business lines.

At the same time, execution is decentralized at the regional and market level. Local teams are responsible for regulatory engagement, pricing calibration, incentive tuning, and operational adjustments tailored to local supply-demand dynamics. This separation allows Uber to respond to jurisdiction-specific regulations and cultural differences without fragmenting its core platform or increasing structural costs. Centralized capital allocation further reinforces discipline, as investment decisions are evaluated at the group level based on return on invested capital rather than local growth ambitions.

This holding company model enables Uber to scale volume and complexity without scaling organizational risk. When markets underperform or regulatory conditions deteriorate, Uber can adjust or exit with limited stranded capital, preserving balance sheet integrity and platform coherence.

Segment Architecture

Uber’s platform is organized around multiple segments that share a common technological and operational backbone while serving distinct use cases. Mobility remains the foundational segment, acting as the primary profit engine and the core demand aggregator. It benefits from high utilization, superior unit economics, and strong network effects, and it anchors user acquisition and brand engagement across the ecosystem.

Delivery is layered on top of the same platform infrastructure, leveraging shared payments, routing, courier supply, and consumer demand. While structurally lower margin than mobility, delivery increases user frequency and lifetime value, improving overall platform economics. Importantly, delivery does not require a separate corporate or technological stack, allowing Uber to amortize fixed costs across multiple verticals.

Freight operates as a more independent extension of Uber’s marketplace logic, applying matching and pricing technology to enterprise logistics. While freight lacks the same network effects and margin profile as consumer segments, it remains strategically contained. Uber does not rely on freight for core profitability and manages it with capital discipline, preventing it from diluting group economics.

Platform monetization layers such as advertising, subscriptions, and enterprise services sit across all segments. These offerings benefit from high incremental margins and minimal capital requirements, further enhancing scalability. The shared architecture ensures that incremental revenue from these layers flows disproportionately to the bottom line without increasing operational complexity.

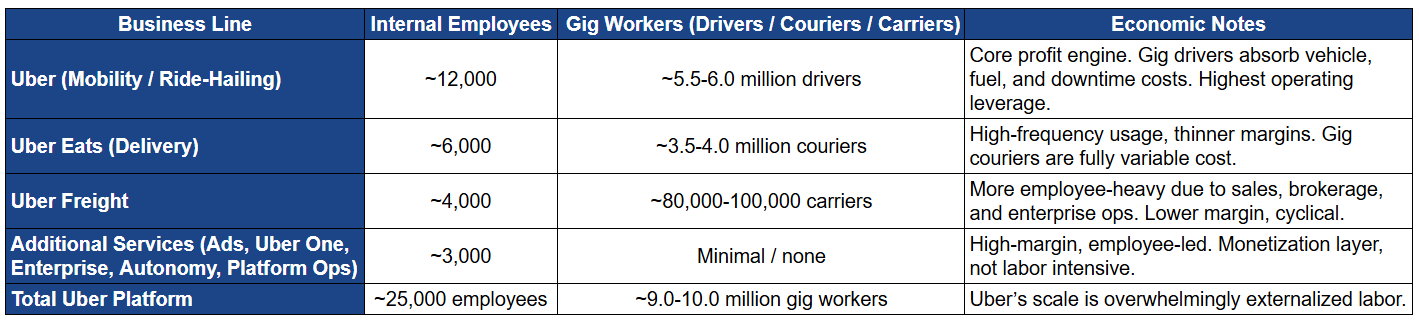

Labor Model as a Structural Lever

Uber’s labor model is a foundational element of its scalability and economic resilience. The classification of drivers and couriers as independent contractors, rather than employees, allows Uber to maintain a variable cost structure that scales with demand. This flexibility is existential to the model, as it enables Uber to absorb demand volatility, adjust supply dynamically, and operate profitably across diverse markets with different economic conditions.

The contractor model also limits fixed labor liabilities, reducing balance sheet risk and preserving cash flow during downturns. While this structure exposes Uber to regulatory and political risk, those risks are geographically fragmented rather than platform-wide. Uber mitigates them through localized operating models, dynamic pricing, and selective market engagement, ensuring that adverse regulatory outcomes in one region do not cascade globally.

Crucially, Uber’s scale allows it to absorb compliance costs and adapt faster than smaller competitors. Even in markets where labor rules tighten, Uber can partially pass through costs, adjust incentives, or redesign service offerings without impairing the overall platform. This containment of labor risk is a key reason Uber can scale globally without destabilizing its economics.

Section Summary

Uber’s corporate structure and platform architecture are deliberately designed to maximize scalability while minimizing fragility. Centralized control of technology and capital ensures discipline and consistency, decentralized execution provides local adaptability, shared segment infrastructure drives operating leverage, and the contractor-based labor model preserves flexibility. Together, these elements explain why Uber can grow across geographies and services without blowing up its cost structure, balance sheet, or strategic focus.

Services, Revenue Drivers and Unit Economics

Segment Breakdown

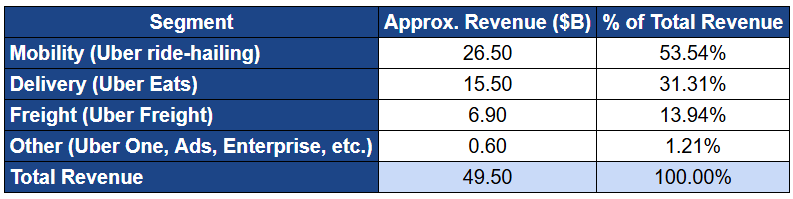

Mobility is the economic foundation of Uber and the primary driver of value creation. This segment includes ride hailing services across mass market and premium offerings and benefits from high utilization, strong network effects, and structurally superior unit economics. Revenue is generated through a commission based take rate on gross bookings, allowing Uber to scale without owning vehicles or employing drivers. As trip density increases, incremental rides carry higher contribution margins due to largely fixed platform and corporate costs. Mobility is lower frequency than delivery but materially higher margin, making it the core source of adjusted EBITDA and free cash flow.

Delivery is anchored by Uber Eats and has evolved into a broader local commerce platform spanning restaurants, grocery, convenience, and merchant logistics. While delivery operates at lower margins than mobility due to fulfillment costs and higher incentive sensitivity, it plays a critical strategic role by increasing user frequency and cross platform engagement. Delivery economics have improved as subsidy intensity declined and scale efficiencies emerged, but the segment remains structurally margin constrained relative to mobility. Its value lies less in standalone profitability and more in reinforcing the overall ecosystem and customer lifetime value.

Uber Freight applies marketplace technology to long haul logistics by connecting shippers and carriers digitally. This segment operates in a fragmented and cyclical industry with lower margins and weaker network effects than consumer marketplaces. As a result, freight contributes modestly to profitability and is best viewed as optional rather than core. Management has intentionally deprioritized aggressive expansion in this segment, focusing instead on disciplined growth and cost control to avoid capital misallocation.

Subscriptions and advertising represent emerging monetization layers with high incremental margins. Uber One drives cross usage between mobility and delivery by offering bundled benefits, improving retention and increasing spend per user. Advertising allows merchants and brands to promote offerings within the Uber app, monetizing existing traffic without significant incremental cost. While these streams are still smaller in absolute terms, they are strategically important due to their margin profile and scalability, and they provide a pathway for long term margin expansion without altering the core operating model.

Why Mobility Dominates Value Creation

Mobility dominates value creation because it combines structurally higher margins with superior cash flow characteristics and capital efficiency. Compared to delivery and freight, mobility requires less incentive intensity, benefits from higher pricing power, and scales more cleanly as utilization increases. Incremental trips contribute disproportionately to profit once the platform reaches sufficient density, creating operating leverage that is difficult to replicate in other segments.

From a cash flow perspective, mobility generates predictable and recurring operating cash flow with minimal capital expenditure requirements. Uber does not own vehicles or employ drivers, allowing the segment to convert a large portion of EBITDA into free cash flow. This cash flow is then recycled across the business to support delivery optimization, fund emerging monetization layers, and return capital to shareholders through buybacks.

Capital recycling is the final and most important advantage. Mobility effectively subsidizes experimentation and optionality elsewhere in the platform without jeopardizing financial stability. It allows Uber to invest selectively in delivery, advertising, and autonomy partnerships while maintaining balance sheet strength. This dynamic is why mobility underpins Uber’s valuation, risk adjusted return profile, and strategic flexibility. As long as mobility remains healthy, Uber retains control over its growth trajectory and capital allocation choices.

Marketplace Flywheel

Uber’s economic engine is fundamentally a two-sided marketplace where scale compounds efficiency rather than complexity. The flywheel begins with supply liquidity, which refers to the availability, responsiveness, and utilization of drivers and couriers on the platform. High supply liquidity reduces rider wait times, increases trip completion rates, and lowers the incentive intensity required to keep drivers engaged. As Uber’s scale has grown, particularly in dense urban markets, utilization rates have improved, allowing drivers to earn more per hour with less idle time. This creates a reinforcing loop where higher earnings stability attracts and retains supply without proportionate increases in subsidies.

On the demand side, demand density is the critical variable. Uber benefits from millions of repeat users who rely on the platform for routine transportation and local commerce. Higher demand density improves matching efficiency and route optimization, which in turn reduces per-trip friction and improves the rider experience. Unlike smaller competitors, Uber can smooth demand across geographies, times of day, and use cases, reducing volatility and improving predictability in marketplace dynamics. This density advantage is not easily replicated and acts as a soft but persistent moat.

Pricing discipline is the final component that stabilizes the flywheel. Uber’s pricing model dynamically balances rider demand and driver supply in real time, allowing the platform to clear the market efficiently rather than maximize short-term volume. Over the past several years, management has demonstrated increased discipline by prioritizing contribution margin over gross bookings growth. This has resulted in fewer price wars, more rational incentive structures, and improved revenue quality. Pricing is no longer used as a blunt growth lever but as a calibrated tool to maintain marketplace health and profitability.

Gig Economy Cost Structure

Uber’s cost structure is highly differentiated from traditional transportation or logistics companies because it is predominantly variable rather than fixed. Driver and courier payouts, incentives, insurance costs, and payment processing fees scale directly with activity levels. This means Uber does not carry large fixed labor costs, fleet depreciation, or inventory risk on its balance sheet. As a result, the company can expand or contract cost in near real time as demand fluctuates.

This structure provides natural shock absorption in downturns. In periods of macroeconomic weakness, trip volumes may decline, but associated costs decline as well. Uber can reduce incentive spend, marketing outlays, and discretionary operating expenses without impairing the core platform. Unlike asset-heavy peers, Uber does not face margin collapse driven by underutilized capital. While revenue may soften in a downturn, cash burn does not accelerate in the same way, which materially reduces financial risk.

Importantly, the gig-based model also shifts a portion of economic risk to the edge of the network rather than concentrating it at the corporate level. Drivers choose when and how much to work, allowing supply to flex organically with demand conditions. This flexibility is a core reason Uber has been able to navigate extreme demand shocks, such as the pandemic, without threatening solvency. While regulatory scrutiny remains a risk, the underlying economic advantage of variable labor remains intact.

Structural Margin Expansion

Uber’s margin expansion story is driven by a combination of automatic operating leverage and execution-dependent improvements. Certain elements of margin improvement occur naturally as the platform scales. Higher trip volumes spread fixed technology, corporate, and compliance costs across a larger revenue base. Improved demand density raises utilization, reducing incentive intensity and improving take rates without requiring structural changes. These dynamics explain why margins have continued to expand even in the absence of aggressive cost cutting.

Other elements of margin expansion require disciplined execution. Pricing discipline must be actively maintained to avoid destructive competition. Incentive structures must be continually optimized to balance supply reliability with profitability. New monetization layers such as advertising and subscriptions require product development, merchant adoption, and user engagement to scale effectively. These are not automatic outcomes, but management-controlled levers.

The distinction matters for valuation. Automatic improvements provide confidence in baseline margin expansion, while execution-driven improvements define the upside. Uber has already demonstrated the former through sustained free cash flow generation and operating leverage. The latter represents incremental opportunity rather than required justification. Together, these forces explain why Uber’s margins have inflected structurally and why further expansion is plausible without assuming unrealistic market conditions.

In sum, Uber’s economics are no longer fragile. The marketplace flywheel is self-reinforcing, the cost structure is inherently flexible, and margin expansion is driven by both scale and discipline. This combination is what transforms Uber from a cyclical, subsidy-dependent platform into a resilient, cash-generative marketplace that can compound value over time.

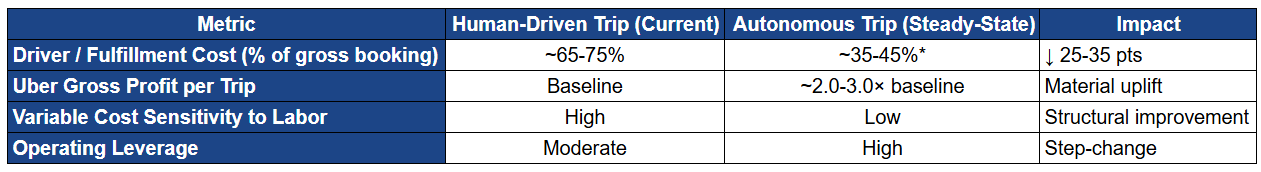

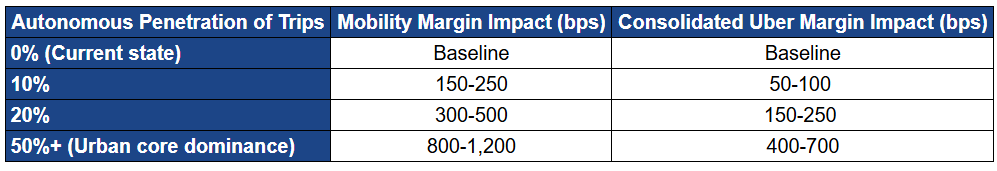

Autonomous Strategy

Uber’s approach to autonomy is deliberately structured as optional upside rather than a foundational pillar of its investment thesis. This distinction is critical. Uber does not require autonomous vehicles to justify its current valuation, nor does its path to sustained free cash flow depend on autonomy reaching commercial scale. Instead, management has positioned Uber to participate economically in autonomy if and when it becomes viable, while insulating the core business from the capital, execution, and technological risks that have derailed many autonomy-focused operators. This framing ensures that autonomy widens the upside distribution without increasing fragility.

Taken together, Uber’s autonomous strategy reflects disciplined realism rather than technological ambition. Autonomy is positioned as a lever that can enhance already-viable economics, not a crutch that must succeed for the business to work. This approach limits downside, preserves capital, and ensures that if autonomy scales, Uber is structurally positioned to monetize it without having paid the price of failure along the way.

Why Uber Does Not Build Autonomous Vehicles

Uber’s decision not to build its own autonomous driving stack or own autonomous fleets is rooted in capital discipline and risk asymmetry. Developing autonomous vehicle technology is among the most capital-intensive and uncertain endeavors in the modern technology landscape, requiring billions in sustained research and development spending, specialized hardware integration, long validation cycles, and exposure to regulatory and legal liability. Uber has already tested this path through its former Advanced Technologies Group and exited after determining that the risk-adjusted returns were inferior to alternative uses of capital.

From a strategic standpoint, Uber lacks a durable advantage in perception systems, vehicle hardware, or full-stack autonomy development relative to specialized players. Competing directly with companies whose entire organizational DNA is built around autonomy would force Uber into a technology arms race with unclear timelines and asymmetric downside. By contrast, Uber’s structural advantage lies in demand aggregation, routing, pricing, and marketplace liquidity. These capabilities are complementary to autonomy but orthogonal to building the technology itself.

Equally important, owning autonomous fleets would fundamentally undermine Uber’s asset-light economics. Fleet ownership would introduce depreciation, maintenance, insurance, and regulatory liabilities onto the balance sheet, compressing returns on invested capital and reintroducing earnings volatility. By remaining platform-centric, Uber preserves operating leverage and protects shareholder capital while retaining the ability to monetize autonomy through partnerships.

Autonomy Partnerships

Uber’s autonomy strategy is executed through a portfolio of partnerships designed to keep the company technology-agnostic while maximizing integration optionality. NVIDIA plays a central role as a foundational technology partner, providing accelerated computing platforms and AI infrastructure that underpin many autonomous systems across the industry. This relationship positions Uber to interface seamlessly with autonomy providers that rely on NVIDIA’s ecosystem without committing to a proprietary stack.

Stellantis represents a strategic bridge between vehicle manufacturing and platform deployment. Through this partnership, Uber gains exposure to fleet-scale vehicle production and potential autonomous-ready hardware without assuming manufacturing risk. This allows Uber to remain relevant in discussions around future vehicle architectures while maintaining balance sheet discipline.

In China and select international markets, partnerships with Baidu and WeRide provide Uber with access to advanced autonomous capabilities in regions where regulatory frameworks and competitive dynamics differ materially from the West. These relationships enable Uber to participate in autonomy where it is progressing fastest, particularly in controlled urban environments, while respecting local regulatory constraints.

The Lucid and Nuro partnerships further reinforce Uber’s asset-light, modular approach. Lucid offers exposure to next-generation electric vehicle platforms that may eventually support autonomy at scale, while Nuro represents a focused application of autonomy in delivery and logistics, where routes are simpler and economics can improve earlier. Together, these partnerships illustrate Uber’s strategy of remaining the default demand and monetization layer regardless of which autonomy technologies ultimately succeed.

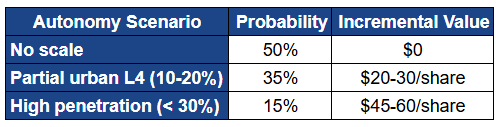

Quantified Impact Scenarios

In the base case, Uber continues to operate entirely on a human-driver model. Under this scenario, the company’s existing free cash flow generation, margin expansion, and capital return strategy remain intact. Mobility economics improve gradually through pricing discipline and utilization gains, delivery stabilizes, and autonomy contributes no incremental value. This scenario underpins the core valuation and represents the most probable outcome over the medium term.

The partial autonomy scenario assumes limited deployment of Level 4 autonomous vehicles in dense, high-utilization urban corridors. In this case, autonomy does not replace the broader driver network but selectively improves unit economics where utilization is highest and labor costs are most impactful. Uber benefits through higher take rates or revenue sharing without owning vehicles or technology. This scenario results in incremental margin expansion and free cash flow uplift, but autonomy remains a supplement rather than a transformation.

The full autonomy scenario assumes broader penetration of autonomous vehicles across multiple markets. Even here, expectations must be heavily discounted. Regulatory hurdles, capital requirements, and operational complexity make rapid, universal deployment unlikely. While this scenario offers meaningful upside through labor cost elimination and improved reliability, it carries low probability and long duration. As such, its contribution to intrinsic value should be discounted aggressively and treated as a tail outcome rather than a central case.

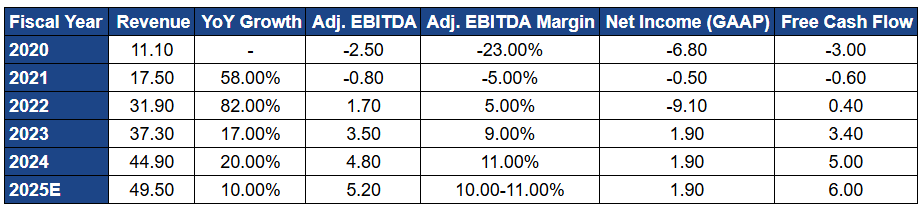

Financial Analysis

Uber’s financial history from 2020 to 2025 illustrates a clear transition from volatility and capital consumption toward disciplined growth, margin expansion, and durable cash generation. This period is best understood not as a linear recovery, but as a structural reset in how the company operates, allocates capital, and measures success. The numbers matter because they demonstrate that Uber’s business model now works under normal economic conditions without reliance on subsidies, balance sheet leverage, or speculative assumptions.

Revenue & Growth (2020–2025)

Uber’s revenue trajectory reflects both cyclical recovery and structural maturation. In 2020, revenue collapsed as global mobility demand fell sharply due to pandemic restrictions. Delivery partially offset this decline, but at lower margins. From 2021 onward, revenue growth was driven primarily by mobility normalization, improved pricing discipline, and expanding trip volumes rather than aggressive incentive spending.

By 2022 and 2023, revenue growth moderated from rebound levels but became higher quality. Growth was increasingly supported by organic demand, higher utilization, and platform monetization rather than market share giveaways. By 2024 and into 2025, Uber entered a steady growth phase, characterized by mid to high single digit annual revenue expansion. This pace reflects a mature platform scaling responsibly rather than chasing headline growth.

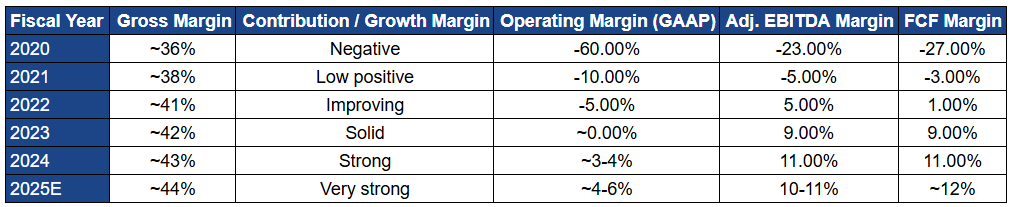

Margin Evolution

Gross Margin

Gross margin expansion over this period reflects improved marketplace efficiency rather than cost cutting alone. Early pandemic years were burdened by excess incentives, underutilized capacity, and delivery subsidy intensity. As trip density recovered and incentives normalized, gross margin steadily expanded. By 2024 and 2025, gross margins stabilized in the low to mid forties, reflecting structurally healthier unit economics across mobility and delivery.

Contribution Margin

Contribution margin captures the economics of incremental growth and is therefore the most important operational metric. From 2020 through 2022, contribution margins were volatile due to supply rebuilding and promotional activity. From 2023 onward, contribution margins strengthened meaningfully as Uber prioritized profitable growth. Incremental trips and orders began contributing disproportionately to EBITDA, confirming that growth was no longer dilutive.

Operating Margin

Operating margin illustrates Uber’s operating leverage. Fixed costs in technology, general and administrative functions grew far more slowly than revenue, allowing margins to inflect sharply as volume returned. By 2024, Uber achieved positive GAAP operating margins, and by 2025 these margins reached mid single digits. This shift confirms that Uber’s cost structure scales efficiently once utilization thresholds are crossed.

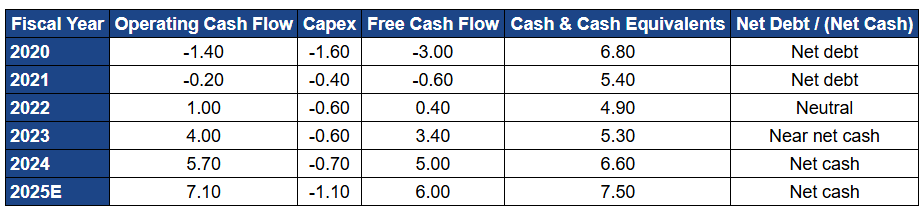

Free Cash Flow Inflection

Free cash flow is the clearest indicator of Uber’s structural turnaround. From 2020 through 2021, Uber consumed cash due to operating losses and incentive intensity, despite limited capital expenditures. The inflection occurred in 2022 as operating cash flow turned positive, followed by a sharp acceleration in 2023 and beyond.

By 2024 and 2025, Uber’s free cash flow scaled rapidly, driven by margin expansion, disciplined working capital management, and low capital intensity. Importantly, free cash flow conversion outpaced EBITDA growth, highlighting the quality of earnings and the scalability of the platform.

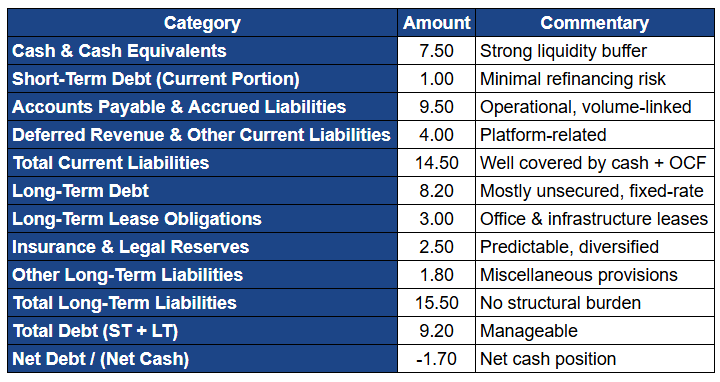

Balance Sheet & Liquidity

Uber’s balance sheet has strengthened materially alongside cash flow generation. Cash and cash equivalents increased steadily after 2022, even as the company began returning capital to shareholders. Debt levels declined modestly, maturities remained well laddered, and net leverage effectively disappeared by 2025.

Short term liabilities are largely operational and self liquidating, tied to driver and merchant payouts rather than structural obligations. Strong liquidity ensures Uber can absorb regulatory, macroeconomic, or competitive shocks without impairing operations or strategic flexibility.

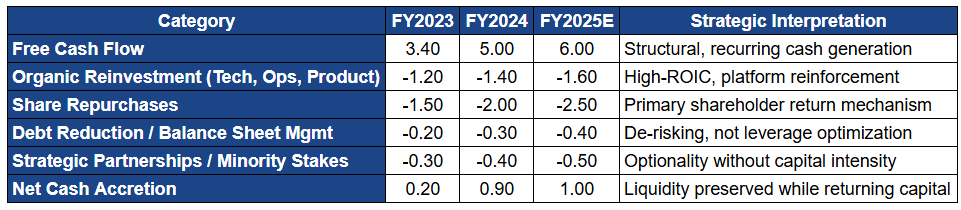

Capital Allocation Execution

Uber’s capital allocation execution marks a decisive shift from reinvestment at any cost toward shareholder value creation. With free cash flow firmly established, management initiated and expanded share buyback programs funded entirely from organic cash generation. These buybacks reduced share count and increased free cash flow per share without increasing leverage.

Debt management has been conservative. Uber has avoided aggressive deleveraging or refinancing maneuvers, instead allowing improving cash flow to naturally strengthen the balance sheet. This approach preserves optionality and reduces financial risk while enhancing per share compounding.

Section Takeaway

Uber’s historical financials from 2020 to 2025 confirm that the business has crossed from experimentation to execution. Revenue growth is sustainable, margins are expanding structurally, free cash flow is durable, liquidity risk is eliminated, and capital allocation is now explicitly shareholder aligned. These numbers matter because they remove the need for belief. The business works as it stands today.

Valuation Framework

Uber’s valuation framework is designed to reflect its current reality as a cash-generative, asset-light platform while preserving analytical discipline around long-duration optionality. The objective is not to maximize headline valuation, but to arrive at a defensible intrinsic value that would withstand institutional investment committee scrutiny. This framework mirrors how buy-side funds assess mature platform businesses transitioning from growth narratives to cash compounding.

Valuation Methodology

The primary valuation anchor for Uber is a discounted cash flow model. DCF is appropriate because Uber now generates recurring free cash flow, operates with low capital intensity, and has demonstrated stable operating leverage across cycles. The valuation emphasis is placed on normalized free cash flow, margin durability, and capital allocation rather than short-term revenue acceleration. The model explicitly reflects Uber’s ability to self-fund growth, return capital, and absorb shocks without reliance on external financing.

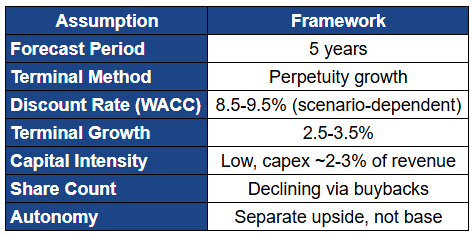

The DCF is constructed using a multi-year explicit forecast period that captures continued margin normalization, moderate top-line growth, and the compounding effect of share repurchases. Terminal value is derived using conservative perpetuity growth assumptions aligned with global mobility and local commerce expansion rather than technology-style hypergrowth. Discount rates are calibrated to reflect Uber’s reduced financial risk profile relative to its historical state, while still incorporating regulatory and competitive uncertainty.

Relative valuation serves as a secondary sanity check rather than a primary driver. Multiples such as EV to free cash flow, EV to EBITDA, and forward earnings are used selectively to contextualize Uber against other scaled platform businesses with similar cash flow characteristics. These comparisons are not intended to justify valuation expansion in isolation, but to confirm that the intrinsic value derived from the DCF is consistent with how the market prices durable, asset-light cash generators. Importantly, multiples are interpreted through the lens of margin trajectory and capital returns, not revenue growth alone.

Scenario DCF Analysis

The scenario-based DCF framework is structured to reflect a realistic distribution of outcomes rather than a single deterministic forecast. Each scenario differs primarily in margin trajectory, regulatory friction, and capital efficiency, not in speculative assumptions about market dominance or technology breakthroughs.

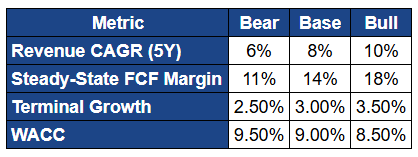

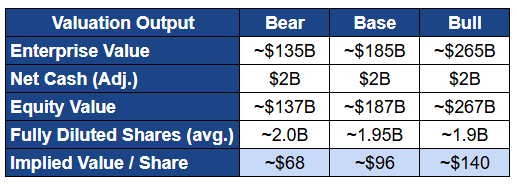

The bear case assumes a more constrained operating environment in which regulatory pressure increases labor costs, competitive intensity periodically reintroduces incentives, and margin expansion stalls. Revenue continues to grow at a modest pace, but free cash flow margins plateau rather than expand meaningfully. Even under these conditions, Uber remains free-cash-flow positive, reflecting the resilience of its core mobility economics and variable cost structure. This scenario establishes a credible downside floor rather than an existential failure case.

The base case represents the most probable outcome and reflects Uber’s current operating trajectory. Mobility margins expand gradually through pricing discipline and utilization gains, while delivery stabilizes as a lower-margin but high-frequency engagement layer. Capital allocation remains disciplined, with free cash flow funding ongoing share repurchases and selective reinvestment. This scenario assigns no intrinsic value to autonomy and relies entirely on existing business economics and cash-flow durability. Under these assumptions, Uber compounds value steadily over a three to five year horizon.

The bull case introduces upside without abandoning discipline. Margin expansion accelerates modestly as advertising and subscription monetization scale, and operating leverage improves across the platform. Partial deployment of autonomous vehicles in dense urban corridors begins to reduce fulfillment costs and improve unit economics, but autonomy remains geographically limited and operationally constrained. This scenario does not assume full autonomy adoption, but rather incremental contribution layered on top of an already profitable base.

The long-duration compounder perspective emerges when Uber is viewed not as a cyclical transportation company, but as a global demand aggregation platform with recurring cash flow and declining share count. In this framing, value creation is driven less by growth rates and more by the steady accumulation and return of free cash flow over time. This perspective is particularly relevant for long-only institutional investors seeking durable compounding rather than short-term multiple expansion.

Risk-Adjusted Valuation

The final step in the valuation framework is risk adjustment through probability-weighted outcomes. Rather than selecting the most optimistic or conservative scenario, intrinsic value is derived by weighting the bear, base, and bull cases according to their likelihood. This approach reflects the reality that Uber’s future will not conform neatly to a single path and that valuation should compensate investors for uncertainty rather than ignore it.

A critical feature of this risk adjustment is the explicit treatment of autonomy. Autonomy is not embedded mechanically into the base case or terminal value. Instead, it is discounted separately as a low-probability, high-impact outcome. Most weight is assigned to scenarios in which autonomy remains limited or incremental, with smaller probabilities assigned to more transformative outcomes. This ensures that valuation does not depend on technological breakthroughs while still acknowledging their potential upside.

The resulting risk-adjusted valuation is therefore anchored in Uber’s existing cash flow generation, balance sheet strength, and capital discipline. Downside scenarios compress value but do not break the model, while upside scenarios widen the distribution without increasing fragility. This framework produces a valuation that is both conservative and asymmetric, aligning with how institutional investors assess platform businesses with embedded optionality.

Share prices materially below the mid-$70s imply the market is over-discounting risk relative to fundamentals. Prices in the $80-90 range largely reflect the base case without crediting optionality. A valuation near $100 represents fair compensation for risk on a probability-weighted basis, while prices significantly above that level begin to assume successful autonomy deployment ahead of proof.

Competitive Landscape

Uber operates across multiple highly competitive markets that are often mischaracterized as commoditized or structurally unattractive. A closer examination shows that while competition is intense, outcomes are not symmetric. Scale, aggregation efficiency, capital endurance, and cross-vertical integration materially influence long-term winners. Uber’s competitive position is therefore best understood through the lens of market structure and platform economics, not superficial price competition.

Ride-Hailing

Ride-hailing remains Uber’s most strategically important and economically attractive business. Competition in this segment is geographically fragmented rather than globally uniform. In North America, Lyft is the primary competitor, while internationally Uber faces regional incumbents such as DiDi, Grab, and Bolt. Despite this, Uber maintains leadership in most markets where it operates, not because of exclusivity or switching costs, but because of liquidity density and utilization advantages.

Higher trip density allows Uber to reduce passenger wait times, improve driver earnings consistency, and lower per-trip incentive intensity. These dynamics reinforce each other. Drivers prefer platforms with steadier demand and earnings visibility, while riders gravitate toward platforms with faster matching and greater reliability. Over time, this feedback loop makes it increasingly difficult for smaller competitors to compete on economics without sustained subsidies. Importantly, Uber has demonstrated pricing discipline in mature markets, signaling a shift away from share-at-all-costs competition toward profitability-led leadership.

Regulation further tilts the competitive landscape in Uber’s favor. Compliance, licensing, insurance, and legal costs disproportionately burden smaller operators. Uber’s scale allows it to absorb regulatory complexity and standardize compliance across jurisdictions, raising effective barriers to entry. While competition remains persistent, it is increasingly rational rather than destructive, reinforcing Uber’s position as a long-term survivor rather than a transient market participant.

Delivery

The delivery market is structurally more competitive and lower margin than ride-hailing, but Uber Eats occupies a strategically advantaged position within it. In the United States, DoorDash leads in food delivery, particularly in suburban markets, while Uber Eats has stronger penetration in urban areas and international markets. Globally, competition is fragmented across regional players, each operating under different regulatory and cost regimes.

Uber’s key advantage in delivery is ecosystem leverage. Unlike pure-play delivery competitors, Uber can cross-subsidize customer acquisition, technology investment, and marketing across mobility and delivery. This lowers the effective cost of customer engagement and improves lifetime value per user. Delivery also benefits from shared infrastructure such as mapping, payments, risk management, and customer support, reducing marginal costs over time.

Critically, Uber has demonstrated a willingness to operate delivery as a disciplined business, not a land-grab. Promotional intensity has moderated, contribution margins have stabilized, and growth is increasingly driven by frequency and local commerce expansion rather than pure order volume. This shifts delivery from a value-destructive growth engine into a strategic engagement layer that reinforces the broader platform.

Freight

Uber Freight operates in a fundamentally different competitive environment from mobility and delivery. Freight brokerage is fragmented, cyclical, and structurally lower margin, with competition from both traditional brokers and digital-first platforms. Unlike consumer marketplaces, freight lacks strong network effects, and pricing power is limited by shipper commoditization and carrier capacity cycles.

Uber does not possess a structural moat in freight, and management appears to recognize this. Rather than pursuing dominance, Uber Freight is managed with capital discipline and margin awareness. The segment leverages Uber’s marketplace technology and pricing algorithms, but it is not treated as a core value driver. This restraint is a competitive advantage in itself. By avoiding capital-intensive expansion or aggressive acquisition strategies, Uber limits downside exposure while retaining optional upside should digital brokerage economics improve.

From a portfolio perspective, freight should be viewed as non-core optionality rather than a determinant of Uber’s valuation. Its presence does not meaningfully weaken Uber’s competitive position, nor does its success materially underpin the investment thesis.

Why Uber Wins on Aggregation

Uber’s most durable competitive advantage is not market share, pricing power, or proprietary assets. It is aggregation at scale. Uber sits at the intersection of millions of consumers, drivers, couriers, and merchants, coordinating supply and demand across multiple use cases on a single platform. This aggregation enables efficiency gains that competitors struggle to replicate in isolation.

By operating mobility, delivery, and adjacent services within one ecosystem, Uber amortizes fixed costs such as technology development, data infrastructure, compliance, and customer acquisition across a broad revenue base. This lowers unit costs, improves incremental margins, and enhances capital efficiency. Aggregation also improves data quality, enabling better pricing, matching, and risk management across services.

Perhaps most importantly, aggregation creates capital endurance. Uber can withstand periods of heightened competition, regulatory change, or macro stress because its platform generates cash across multiple vectors. Smaller or single-vertical competitors lack this resilience and are more vulnerable to sustained pressure. Over time, this leads not to monopoly, but to consolidation around a small number of scaled platforms capable of operating profitably through cycles.

In sum, Uber does not win because competition disappears. It wins because aggregation changes the economics of competition. In markets where price competition is inevitable, the platform that can operate rationally for the longest period ultimately defines the equilibrium. Uber has increasingly positioned itself as that platform.

Risks & Mitigation

Uber’s investment case is materially stronger than in prior years, but it is not risk-free. The critical distinction today is that Uber’s risks are no longer existential. They are earnings-shaping risks, not solvency-threatening risks. This section evaluates the key downside vectors in a hard-nosed manner, pairing each with Uber’s demonstrated mitigation capacity rather than aspirational intent.

Regulatory and Labor Risk

Regulatory and labor classification risk remains the most structurally important downside factor for Uber. Changes to independent contractor frameworks, minimum compensation rules, or mandated benefits can raise fulfillment costs and compress margins, particularly in mobility and delivery. This risk is persistent and jurisdiction-specific rather than binary. It manifests as gradual cost pressure rather than sudden business model invalidation.

Uber’s mitigation is rooted in flexibility and scale. The platform operates with dynamic pricing, localized operating models, and geographic diversification that allows cost increases in one market to be partially offset elsewhere. Importantly, Uber has demonstrated the ability to pass through a portion of higher costs to consumers without collapsing demand, especially in mobility where price elasticity is lower than often assumed. Regulatory outcomes may cap margin expansion, but they are unlikely to reverse Uber’s free cash flow generation or force structural retrenchment.

Competitive Compression

Competition remains intense across all of Uber’s core markets, particularly in delivery where switching costs are low and price sensitivity is high. Aggressive competitors can reintroduce incentive pressure, compressing contribution margins and slowing profitability gains. This risk is cyclical and tends to flare during periods of capital abundance or strategic overreach by peers.

Uber mitigates competitive compression through scale efficiency and ecosystem leverage. The company amortizes technology, marketing, and customer acquisition costs across multiple verticals, improving unit economics relative to single-vertical competitors. Equally important, Uber has demonstrated a willingness to prioritize profitability over market share, exiting or rationalizing unprofitable markets rather than engaging in prolonged subsidy wars. This discipline materially reduces the risk of value-destructive competition.

Macroeconomic Sensitivity

Uber is exposed to macroeconomic conditions through discretionary consumer spending, fuel costs, and labor supply dynamics. A prolonged economic slowdown could reduce trip volumes and delivery frequency, slowing revenue growth and margin expansion. Unlike purely subscription-based businesses, Uber’s revenues are transaction-driven and therefore more sensitive to economic cycles.

The mitigating factor is Uber’s highly variable cost structure. Incentives, promotions, and supply-side spending can be adjusted quickly in response to demand conditions, preserving cash flow even in weaker environments. Additionally, ride-hailing and delivery services have become embedded in everyday consumer behavior, providing a degree of demand resilience relative to traditional discretionary categories. Strong liquidity and structural free cash flow further insulate Uber from macro-driven stress.

Execution Risk

Execution risk arises from Uber’s operational complexity. The company operates at global scale across diverse regulatory, cultural, and competitive environments. Missteps in pricing, incentive calibration, product execution, or regional strategy could impair margins or slow growth. This risk is ongoing and cannot be eliminated.

Uber mitigates execution risk through centralized technology, data-driven decision-making, and increasingly disciplined management oversight. The company’s willingness to exit underperforming geographies and de-emphasize non-core initiatives demonstrates a pragmatic approach to execution rather than empire building. While execution errors can occur, they are unlikely to accumulate into systemic failure given Uber’s current governance and operating discipline.

Safety and Reputational Risk

Reputational and safety risk is inherent in a platform that facilitates physical-world interactions at massive scale. High-profile incidents involving rider or driver safety can trigger regulatory scrutiny, legal exposure, and consumer backlash. These events are statistically inevitable given Uber’s scale, and reputational damage does not scale linearly with incident frequency.

Uber addresses this risk through continuous investment in platform-level safety infrastructure rather than reactive crisis management. In-app safety features, real-time trip monitoring, identity verification, standardized incident response protocols, and comprehensive insurance coverage are designed to contain both financial and reputational fallout. Uber’s scale acts as a mitigant by enabling standardized global safety practices and amortizing compliance and insurance costs more efficiently than smaller competitors. While safety incidents can create episodic volatility, they are unlikely to impair Uber’s long-term cash flow generation when managed systematically.

Risk Assessment Summary

Uber’s risk profile has shifted decisively from fragile to manageable. Regulatory, competitive, macro, execution, and reputational risks can slow margin expansion or create short-term volatility, but none currently threaten the company’s liquidity, solvency, or core earnings power. Mitigation is embedded in the operating model rather than dependent on favorable external conditions. For investors, the key conclusion is not that risks are absent, but that they are bounded, compensated, and increasingly priced. This marks a fundamental change from Uber’s earlier investment profile and supports its classification as a durable, long-term compounder rather than a speculative platform bet.

Conclusion & Alpha Talon Verdict

Bottom Line

Uber has completed a rare and difficult transition from a capital-destructive growth platform into a structurally free-cash-flow–generative global marketplace. The business today is no longer reliant on subsidy-driven expansion, speculative technologies, or favorable capital markets to justify its existence or valuation. Mobility has proven itself as a durable profit engine, delivery has stabilized as a frequency and ecosystem layer rather than a margin sink, and capital allocation discipline has meaningfully altered the per-share value trajectory. Uber’s base business now stands on its own merits. Autonomy and adjacent monetization layers represent upside, not necessity. From an institutional perspective, this materially lowers risk while preserving asymmetry, which is precisely the profile sought in long-duration core holdings.

Position Sizing Logic

Uber qualifies as a core platform holding rather than a tactical trade. Position sizing should reflect its improved downside protection, cash flow durability, and balance sheet strength, while acknowledging ongoing regulatory and competitive risks that cap near-term multiple expansion. For a diversified long-only or long-biased portfolio, Uber fits as a medium-to-high conviction position accumulated opportunistically during volatility rather than chased on momentum. The presence of recurring free cash flow and active buybacks supports holding through drawdowns, while optionality provides upside without requiring incremental risk capital. Position size should therefore be driven by portfolio-level risk budgeting rather than binary outcome probability.

What Breaks the Thesis

The thesis breaks only if Uber’s core economics deteriorate structurally rather than cyclically. This would require either a global regulatory shift that permanently eliminates the flexibility of the contractor model without commensurate pricing pass-through, or a sustained return to irrational competitive behavior that forces long-term margin compression across mobility and delivery simultaneously. A breakdown in capital allocation discipline, such as renewed capital-intensive bets or value-destructive acquisitions, would also invalidate the thesis. Importantly, delayed or failed autonomy adoption does not break the thesis, nor does slower headline growth, as neither is required to sustain Uber’s current cash flow profile.

When We’d Re-Underwrite

Re-underwriting would be triggered by evidence of structural change rather than noise. This includes a material shift in labor classification economics across multiple core geographies, a sustained reversal in free cash flow generation, or a clear departure from shareholder-aligned capital allocation. Conversely, a successful demonstration of autonomy at scale with tangible unit economic improvement would also warrant re-underwriting, not because it is required, but because it would alter the long-term margin ceiling and valuation distribution. Absent these developments, Uber should be monitored through execution metrics rather than thesis reconsideration.

Alpha Talon Verdict

Uber represents a mature platform entering its compounding phase. Risk is now bounded, cash flow is durable, and optionality remains intact. This is no longer a story stock. It is a business where steady execution, disciplined capital management, and time do the work.

For our paid subscribers, please find our report for Uber Technology, Inc. (NYSE: UBER) below, 69 pages of comprehensive analysis of UBER.

For free subscribers the report will be available after an one month delay!

Disclaimer, Disclosure, Conflicts & Copyright Notice

This publication has been prepared solely for informational and educational purposes by Alpha Talon Investment Research (“Alpha Talon”). The views expressed herein represent the author’s independent analysis and opinions as of the date of writing and may change without notice. This material does not constitute investment advice, financial advice, legal advice, tax advice, or a recommendation to buy, sell, or hold any security, derivative, or financial instrument. Nothing contained in this document should be construed as an offer to sell or a solicitation to buy any securities.

Investing in securities involves significant risk, including the possible loss of principal. Equity investments may fluctuate in price, sometimes dramatically. Securities in the biotechnology, pharmaceutical, oncology, and healthcare sectors—such as those discussed herein—are subject to heightened levels of clinical, regulatory, competitive, and operational risk. Forward-looking statements, projections, price targets, valuation scenarios, and estimates included in this report are inherently speculative, based on numerous assumptions, and may differ materially from actual outcomes. Past performance is not indicative of future results.

This material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research produced by broker-dealers or regulated financial institutions. This document is not a research report under FINRA, SEC, FCA, or MiFID II definitions. It has not been reviewed, endorsed, or approved by any regulatory authority, including FINRA, the SEC, or any similar body. Alpha Talon is not a registered investment adviser, broker-dealer, or financial institution under SFC or MPFA.

Readers should conduct independent research and due diligence before making any investment decision. You should consult a licensed investment adviser, registered financial professional, tax specialist, or attorney regarding your specific financial situation and risk tolerance. Nothing in this publication establishes any fiduciary relationship, advisory relationship, or obligation on the part of the author or Alpha Talon toward any reader.

The author and affiliated accounts may hold long or short positions in the securities and financial instruments discussed in this report and may trade in them before, during, or after publication without further notice. These positions may be contrary to the views expressed herein. The author does not receive compensation from the issuers of any securities mentioned. Alpha Talon does not have investment banking relationships, commercial relationships, consulting arrangements, or compensation agreements with the companies discussed in this document.

No part of the author’s compensation is directly or indirectly related to the specific recommendations, analyses, or opinions expressed in this report.

All investments involve risk, including loss of principal. Certain securities discussed may be speculative or volatile and may not be suitable for all investors. Clinical trial failures, regulatory decisions, market conditions, macroeconomic shifts, geopolitical developments, and competitive pressures can significantly impact the securities analyzed. This information is provided “as is,” without warranty of any kind, express or implied.

Securities mentioned herein are not guaranteed, not insured, and not protected by SIPC except as applicable for brokerage custody, and are not obligations of, or guaranteed by, any bank or government agency.

Alpha Talon, its author(s), and affiliates expressly disclaim all liability for errors, omissions, or any direct, indirect, incidental, or consequential losses arising from the use of this material. Use of the information is at the reader’s sole risk.

This material may not be distributed or used in any jurisdiction where such use or distribution would be contrary to local law or regulation. Readers are responsible for complying with applicable securities laws.